Powered by

⏱ Avg. Reading Time: 6 min

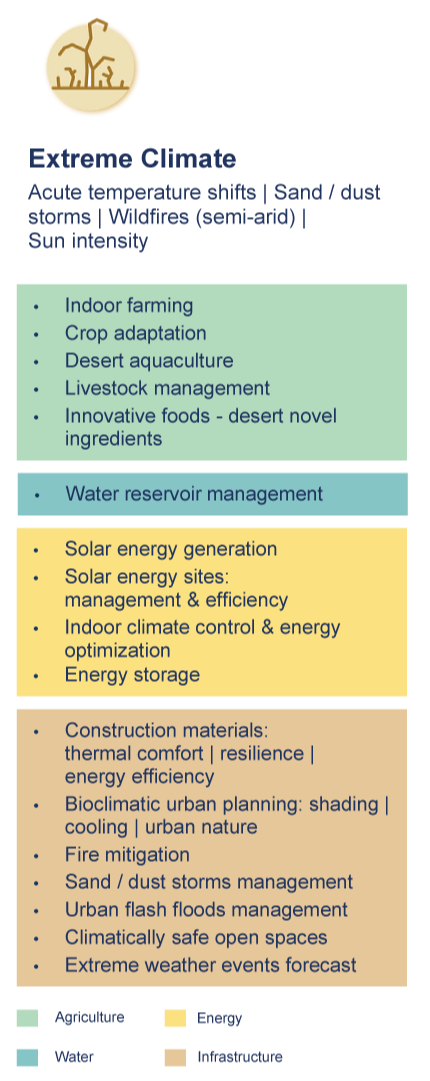

Dust storms, droughts, heat waves, and flash floods are all intensifying environmental threats for desert inhabitants. As desertification increases, agricultural productivity, and income decrease. According to the IPCC Special Report on Climate Change and Land, extreme weather events have the highest potential to increase poverty over the coming decades in dryland areas, urgently necessitating innovative solutions to ensure food security and alleviate poverty.

Heat and dust resilient renewable energy sources, green desert construction, adapted agricultural crops, sustainable land management practices, and prediction systems for extreme weather events are just a few of the solutions needed.

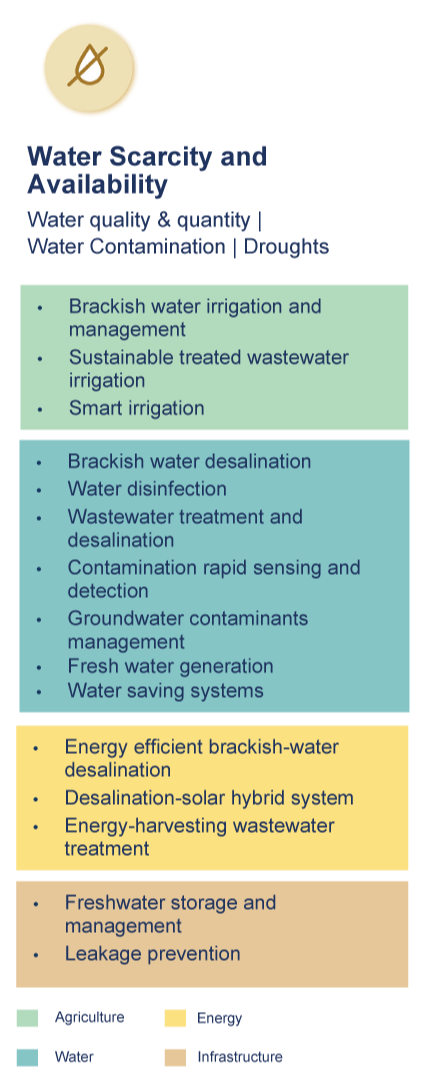

Prolonged droughts and soil degradation will continue to aggravate existing water scarcities rendering life in the desert even more difficult for its inhabitants. Climate change will exacerbate water shortages, negatively impacting regional agricultural systems. By 2025, 1.8 billion people will experience "absolute water stress," threatening water security worldwide, especially in arid regions.

Desalination-solar hybrid system treatment, reuse and treatment of wastewater, water-saving precision irrigation, generation of water from air humidity, and advanced systems for drought forecasting are just a few of the solutions needed.

The lack of food and water security, reliable clean energy, and access to basic healthcare all test the survival of communities living in remote arid environments. The desperation of people living in these drylands is likely to drive them to emigrate leading to additional challenges for the global community. As desertification expands, marginal communities in arid regions will only be able to thrive with the use of new technologies. As of 2019, more than 785 million people in the world did not have access to basic water services.

Off-grid water and sanitation services, non-wire clean energy sources, and innovative self-sustaining food production technologies are just a few of the technologies needed.

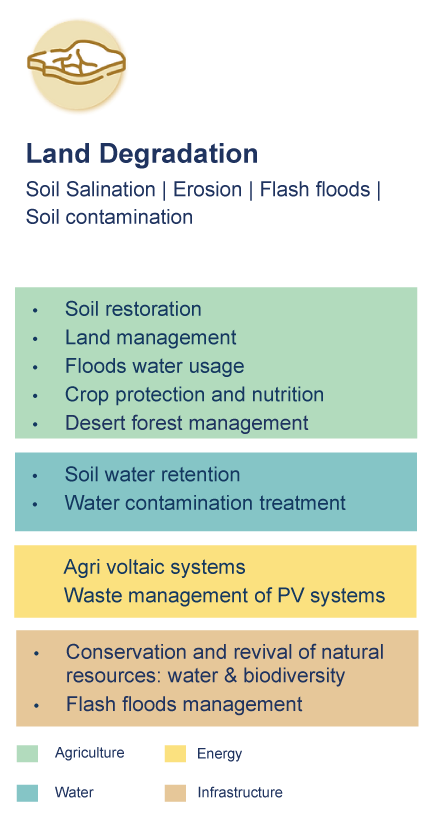

Land degradation is primarily the result of human-related activities and climate variations. When land degradation occurs in drylands it is considered desertification. Unsustainable land management practices and increased pressure on the land to produce combine to drive degradation. Every year, 75 billion tons of fertile soil is lost to land degradation, thus increasing soil vulnerability to water and wind erosion, salination, and flash floods.

Land management techniques using runoff water, soil restoration, agro-voltaic systems, and smart irrigation are just a few of the solutions needed to achieve land degradation neutrality.

The data in the report is updated to March 4th, 2022.

Definitions – DeserTech verticals and solutions definitions were specifically formulated for this project. All other definitions including Funding Stage, Financial Maturity, etc. are taken from the Start-Up Nation Finder glossary.

The companies that were included in the mapping were founded from the year 2000 onward.

Capital raised information in the graphs usually refers to rounds and amounts raised since 2014. The total funding raised by the sector and by each vertical refers to 2006-2022.

As a result of the delay in collecting data on company foundation and funding rounds, the information associated with 2022 is partial, both in terms of the number of companies and the amount of capital raised.

In terms of technologies designed to adapt to desertifying environments, Israel is no stranger to the problem as it had faced these challenges since its establishment with its settlements in arid and semi-arid zones which required appropriate solutions. Solutions that focus mainly on water, agriculture, and energy have formed the basis for the establishment of technology startups that operate in these fields.

There are currently 66 startups dealing with desert challenges, distributed relatively evenly among four verticals: Agriculture, Energy, Water, and Infrastructure, with the last vertical having only half as many startups as the other three.

The number of startups in every vertical except infrastructure is realtively equal.

Figure 3.1: Breakdown of Startups by Vertcial

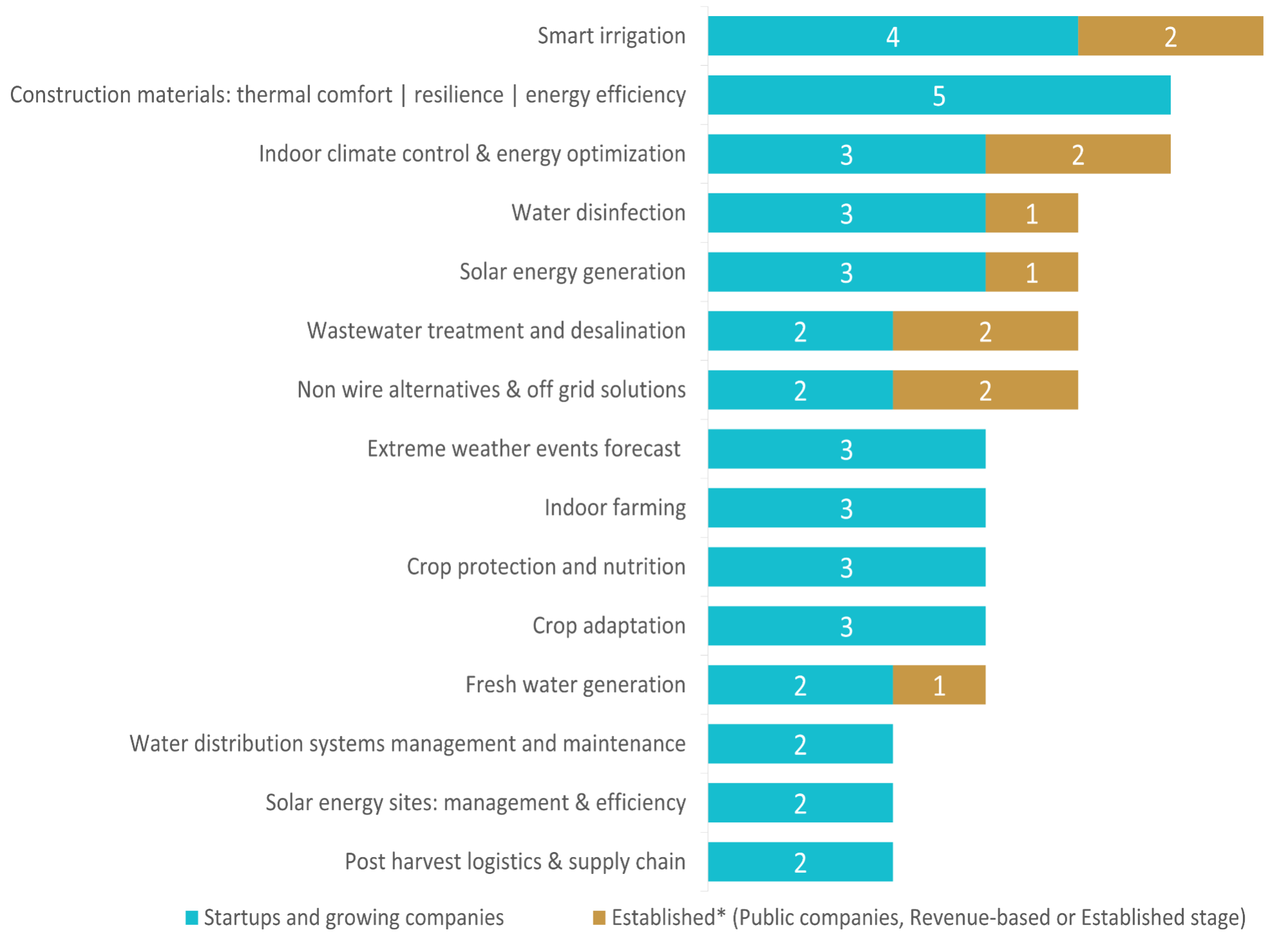

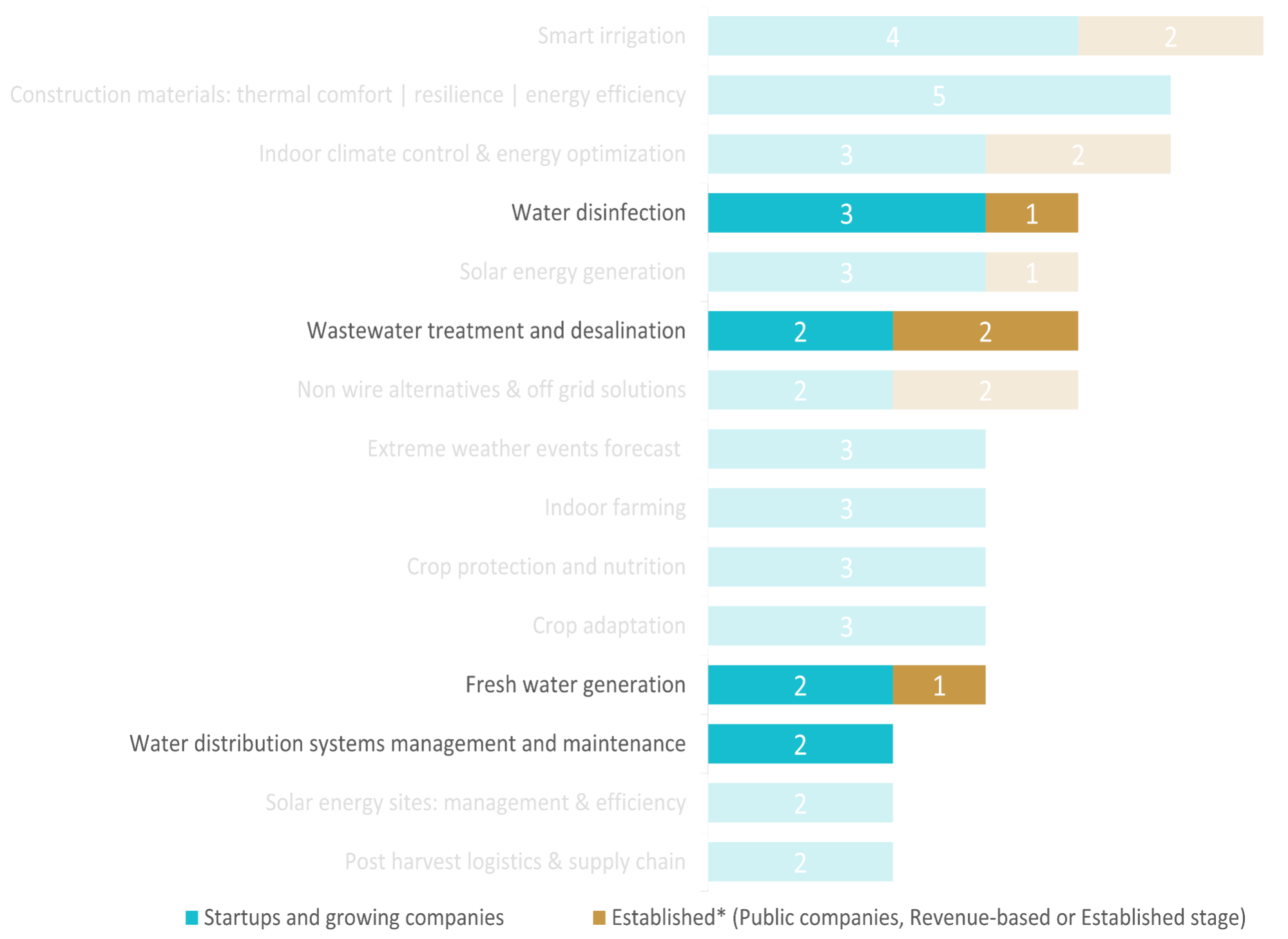

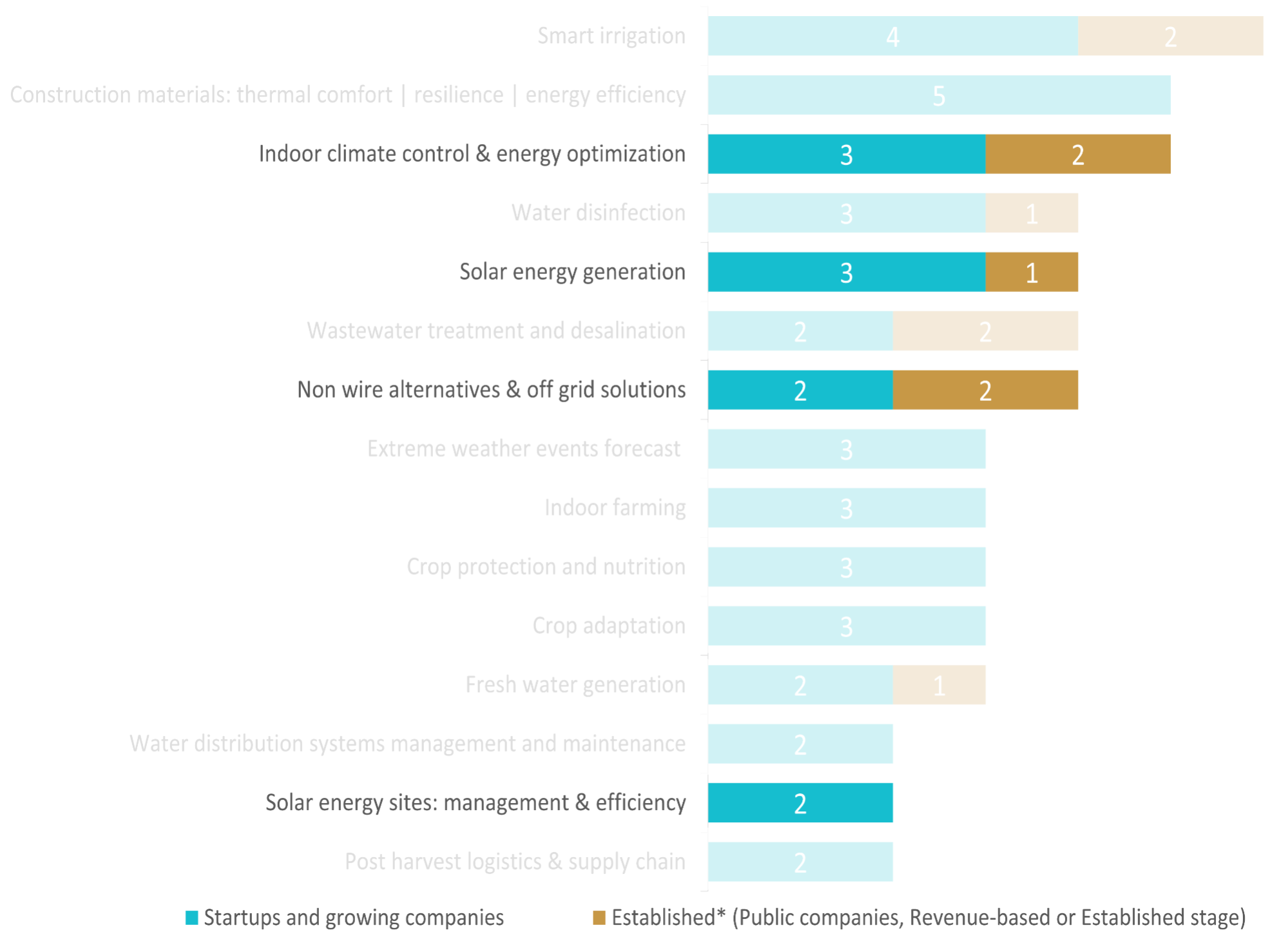

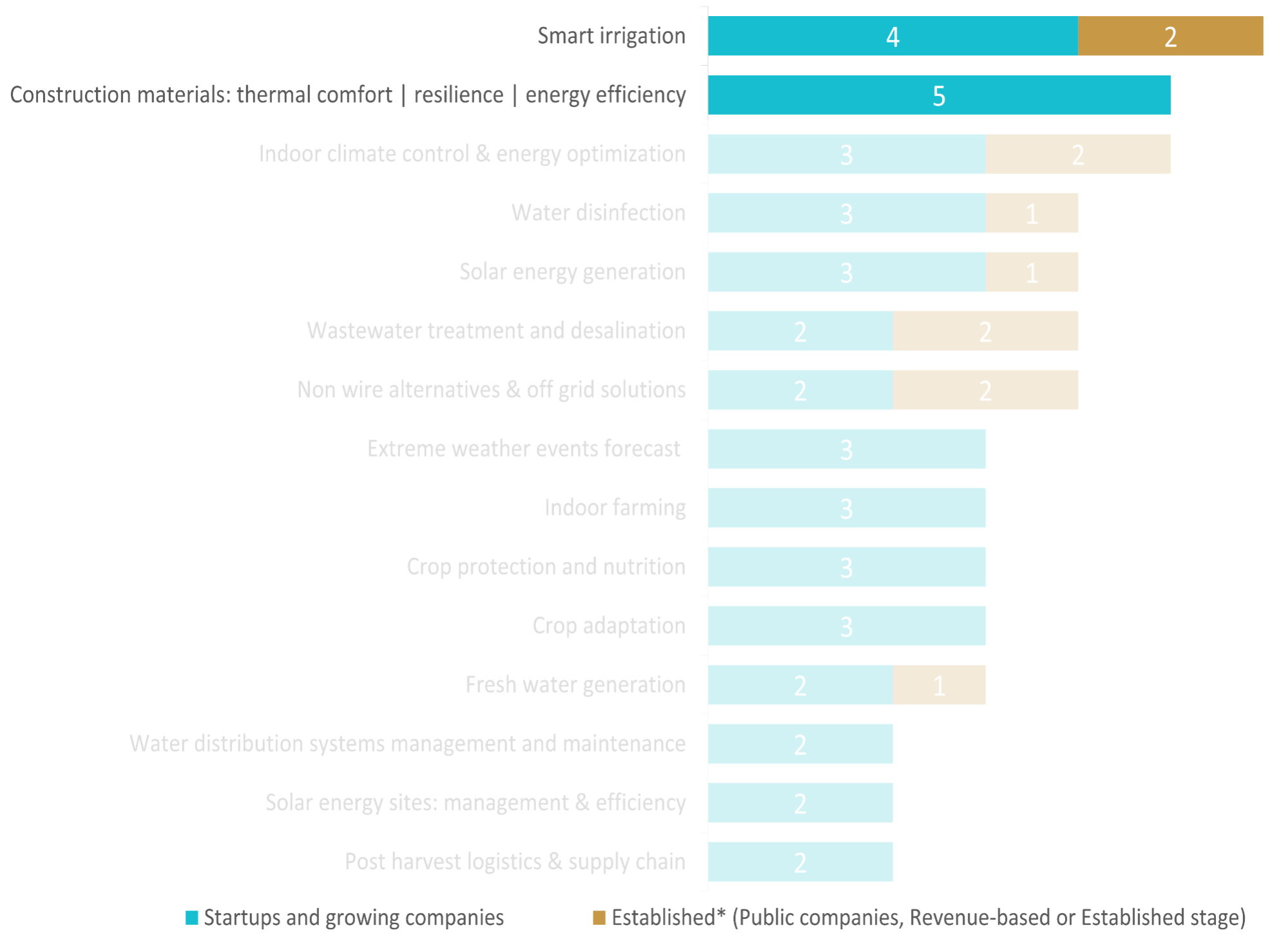

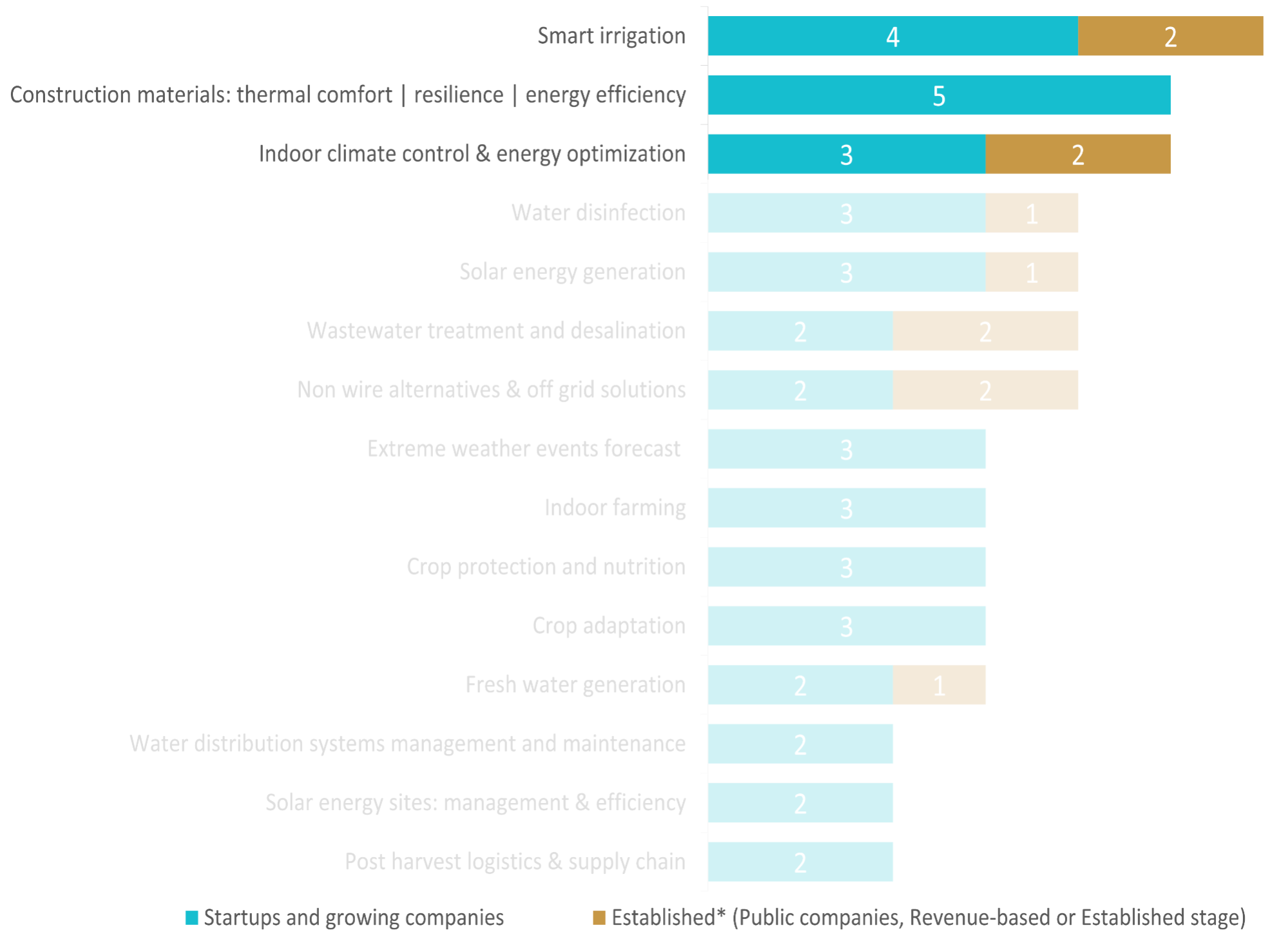

DeserTech startups cover 26 solution fields, seven of which account for approximately 50% of the total number of companies.

These prominent fields are largely focused on water

and energy.

There are also many startups within smart irrigation and construction materials.

These two fields, along with indoor climate control & energy optimization, have raised the most money in their respective verticals, raising between $38M to $89M. Gauzy – a construction materials startup that develops functional glass coatings – raised $60M in a Round D in 2022, and N-Drip – a smart irrigation startup – raised $20M in a Round B in 2021

DeserTech startups cover 26 solution fields, seven of which account for approximately 50% of the total number of companies.

These prominent fields are largely focused on water

and energy.

There are also many startups within smart irrigation and construction materials.

These two fields, along with indoor climate control & energy optimization, have raised the most money in their respective verticals, raising between $38M to $89M. Gauzy – a construction materials startup that develops functional glass coatings – raised $60M in a Round D in 2022, and N-Drip – a smart irrigation startup – raised $20M in a Round B in 2021

Out of the 66 DeserTech companies, 22 have raised a total of $347M. Out of the 4 verticals, agriculture and infrastructure startups together contribute 77% of the total.

Figure 3.7: Breakdown of Total Funding by Vertical (2006-2022)

Focusing on the most up-to-date and accurate data from 2014 onward, the median round size by vertical between 2014-2022 was $1.5-4M. Startups from the energy and agriculture verticals were able to close more funding rounds, with 16 rounds and 15 rounds, respectively, raising $122M combined. Startups from the infrastructure vertical, raised $108M in 13 rounds, although it includes only half as many startups as other verticals.

Figure 3.8: Funding raised in each vertical in $M and number of rounds,

2014-2022

$XXM = Median round size in each vertical

Bubble size = Number of funded startups in the vertical

W/O Post-IPO Equity Funding and Debt Financing

GroundWork BioAg develops and sells mycorrhizal inoculants for commercial farming and raised $11M in 2021 from Israeli and foreign investors. Containing concentrated and vigorous beneficial fungi, the company's Rootella and Dynomyco inoculants can improve soil nutrient uptake in plants, increase crop yields, improve resistance to several types of stress, and reduce fertilizer requirements.

Founded in 2006, Arava Power Company develops, owns, manages, and optimizes utility-scale photovoltaic (PV) systems. In 2011, the company established a commercial solar field in Israel, in Kibbutz Ketura. Throughout the years, the company has established and operates fields with a total output of 120MW.

Founded in 2009, Watergen develops energy-efficient, accessible solutions to generate clean and safe drinking water from the air. It offers 'water-from-air units' in different sizes that can serve a variety of needs and require no infrastructure other than electricity or solar energy.

Kando, a wastewater management solutions company, offers its Kando Pulse digital solution that provides water-quality sensors and samplers, connected to a data fusion and analytics software engine and optimized to deliver operational intelligence in real-time. In 2020, Kando won Seagate's Innovator of the Year competition and in 2021 it raised $6M in a B round – the biggest round within the water vertical that year and the second-biggest round ever within the water vertical.

Gauzy is a functional glass coatings company that develops, manufactures, and markets Light Control Glass (LCG) technology that allows glass to change from transparent to varying degrees of opaque for customized shading, solar control, energy conservation, privacy, and transparent commercial displays. Gauzy raised $60M in a D round in 2022, the biggest round in the vertical.

Asterra, leak prevention solution company, developed satellite-based technology that can identify and locate different types of subsurface water near critical infrastructure such as water and sewer pipes, roadways, and railways. It successfully commercialized its leak-detection product in 2016 and has completed hundreds of projects worldwide. The company raised total funding of $9M.

Since many companies in Israel develop technologies that stem from local conditions, needs, and expertise, it was clear that the potential of the companies that can contribute to dealing with desert challenges is greater than the number of present DeserTech startups. We mapped and identified a significant number of startups that, together with DeserTech startups, compose an ecosystem of 303 startups with the potential to tackle desertification challenges (over the course of this chapter, this potential ecosystem will be referred to as ‘potential DeserTech startups’). More than half of them are related to the agriculture vertical, while energy and water each have 20% of startups, and infrastructure has 5%.

Most DeserTech startups are involved in agriculture.

Figure 4.1: Breakdown of Startups by Vertical

Founded in 2017, SeeTree is an intelligence platform that provides tree-by-tree intelligence to help growers track their health and productivity, and raised $30M in a B round in 2020. With SeeTree, trees and forests can be even more beneficial at stabilizing soil, improving fertility, and protecting against droughts and floods, all of which are crucial to fighting desertification and enabling desert greening visions, such as planting forests in the Sahara, to become a reality

Nostromo Energy has developed the IceBrick ESS, an energy storage system that requires no toxic or rare earth materials. It uses surplus electric power during periods of excess to store cold thermal energy in the form of ice, which is then utilized for cooling during peak hours when the electrical grid is under its highest level of stress. Supported by Shell Ventures, it has raised a total of $7.3M since its establishment