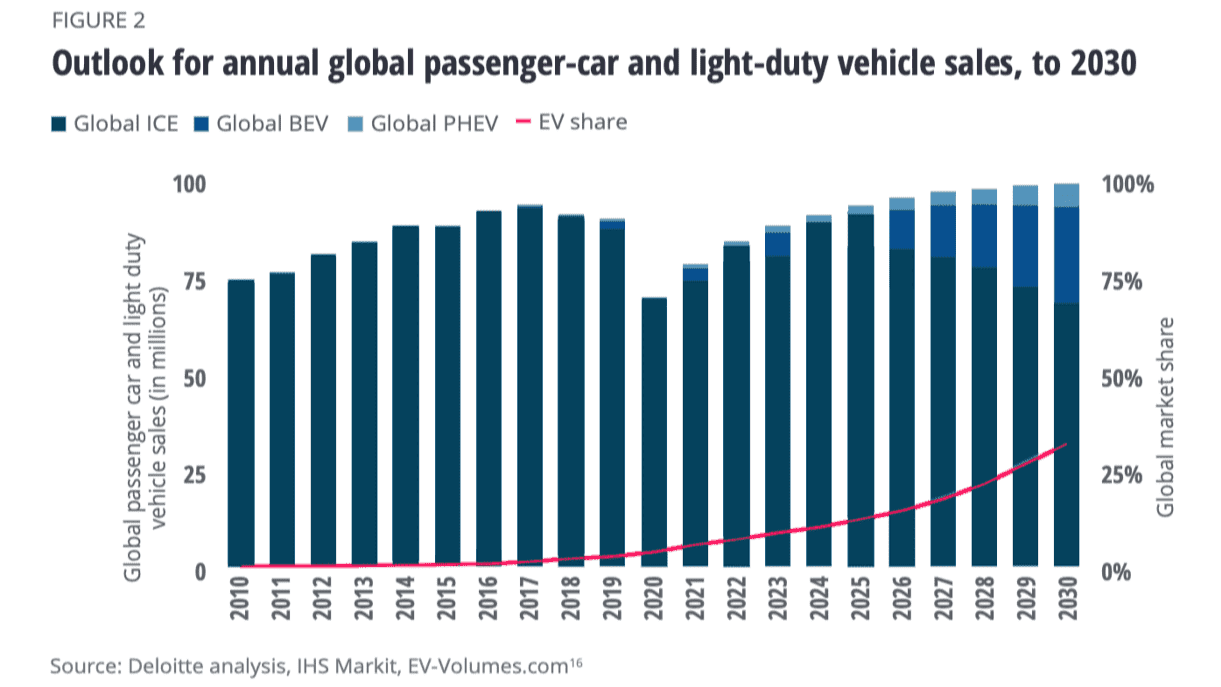

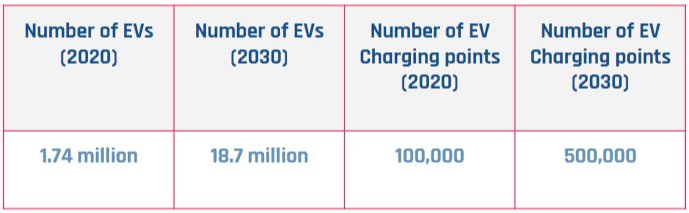

Future Outlook

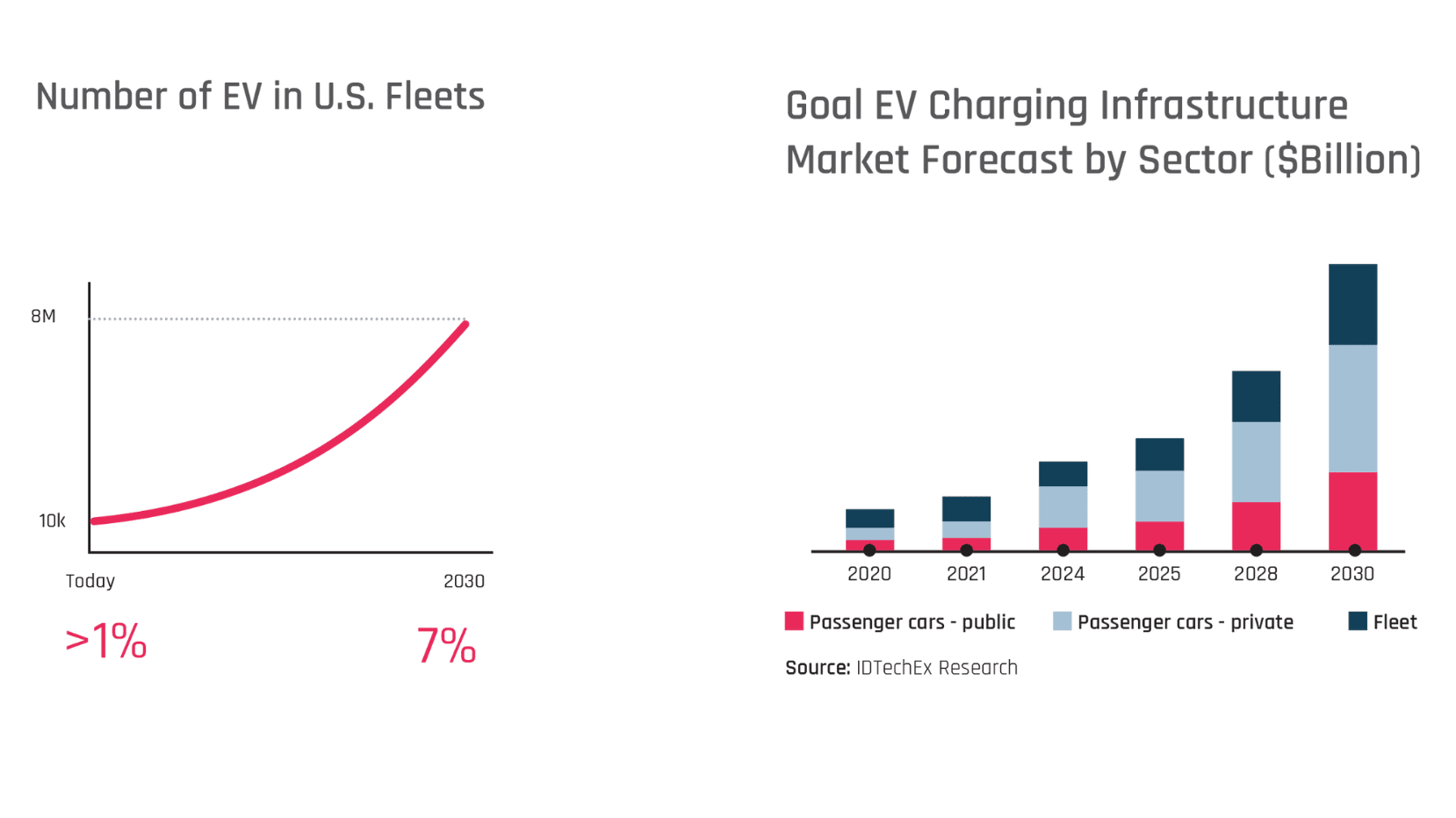

Our objective is to examine what the future will look like in the electric vehicle market as there is a growing number of electric fleets. Fleet management includes needs that differ from those of private consumers, which translates to a variety of additional opportunities for new players who are looking to enter the market. Our future outlook analysis includes 3 aspects: where, when, and how the EV charging infrastructure will look from the perspective of the fleet.

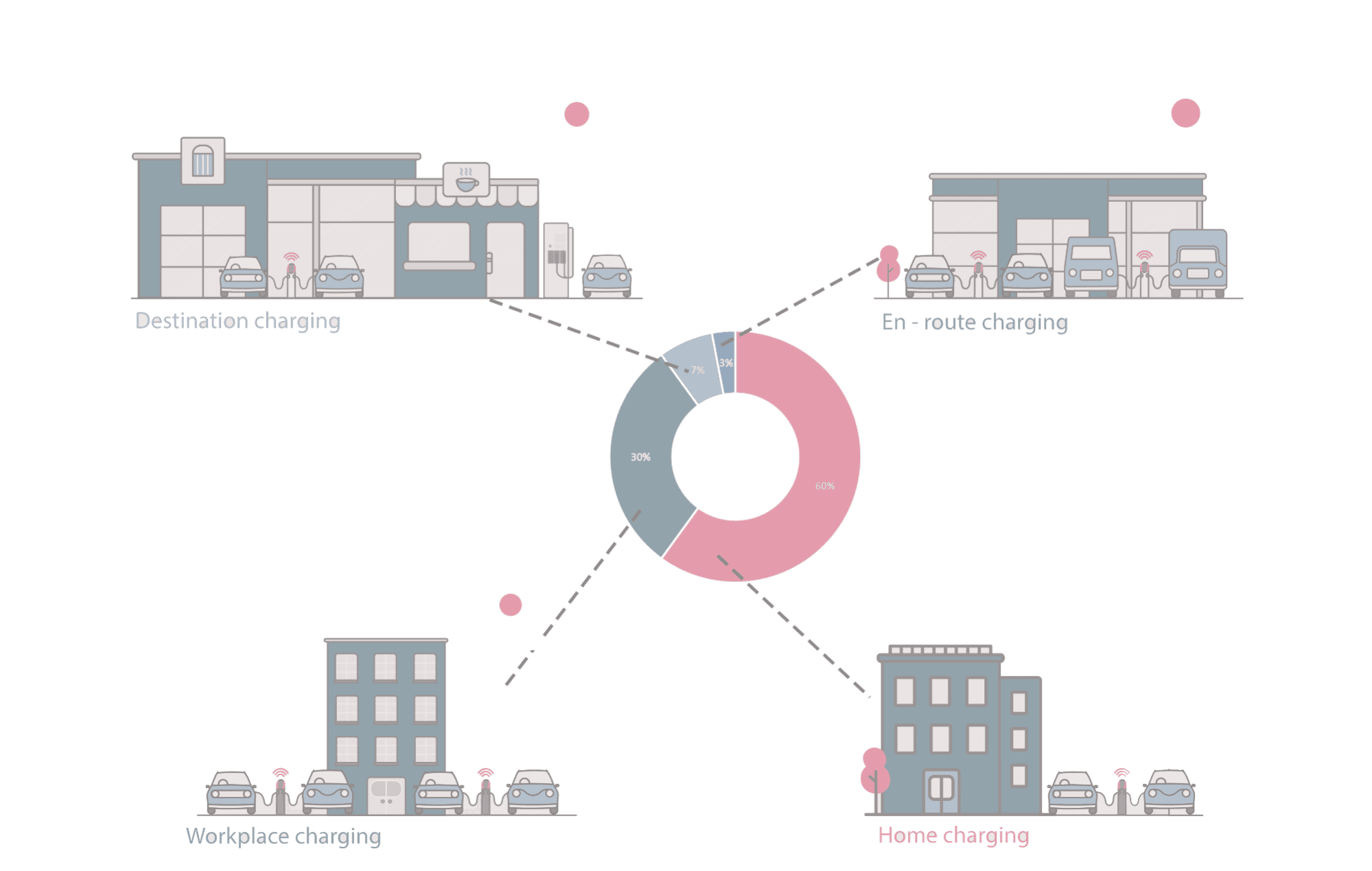

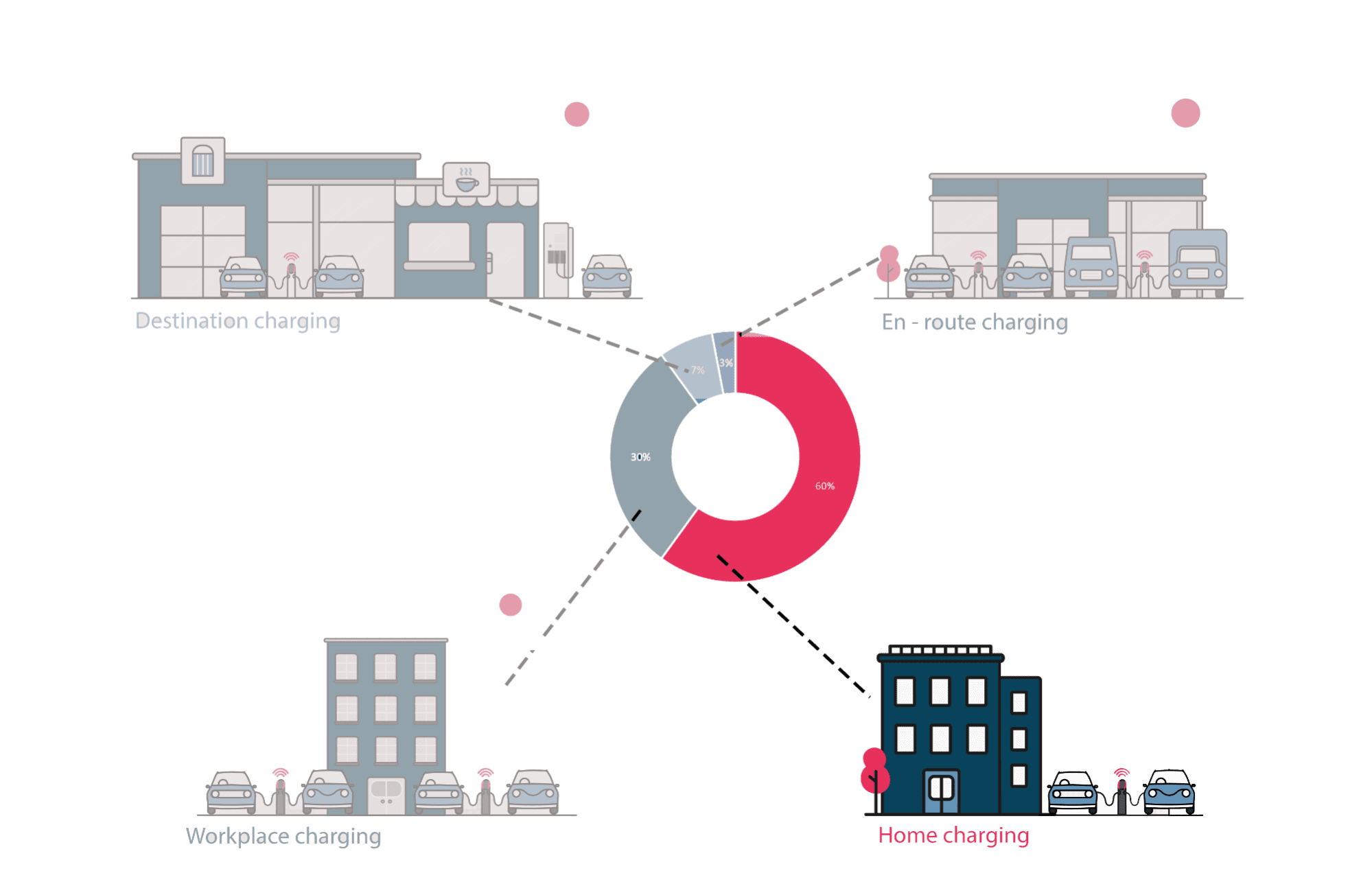

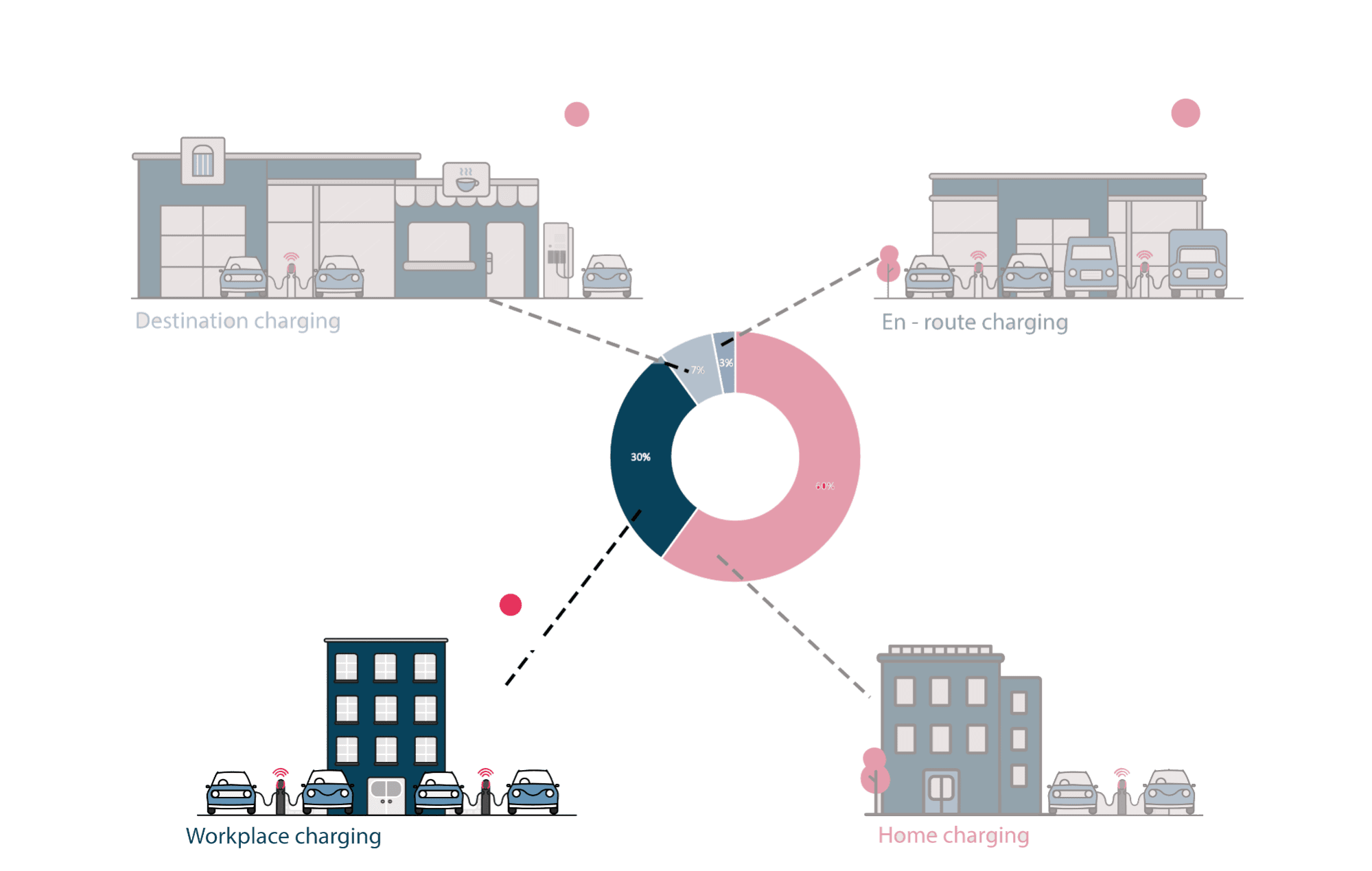

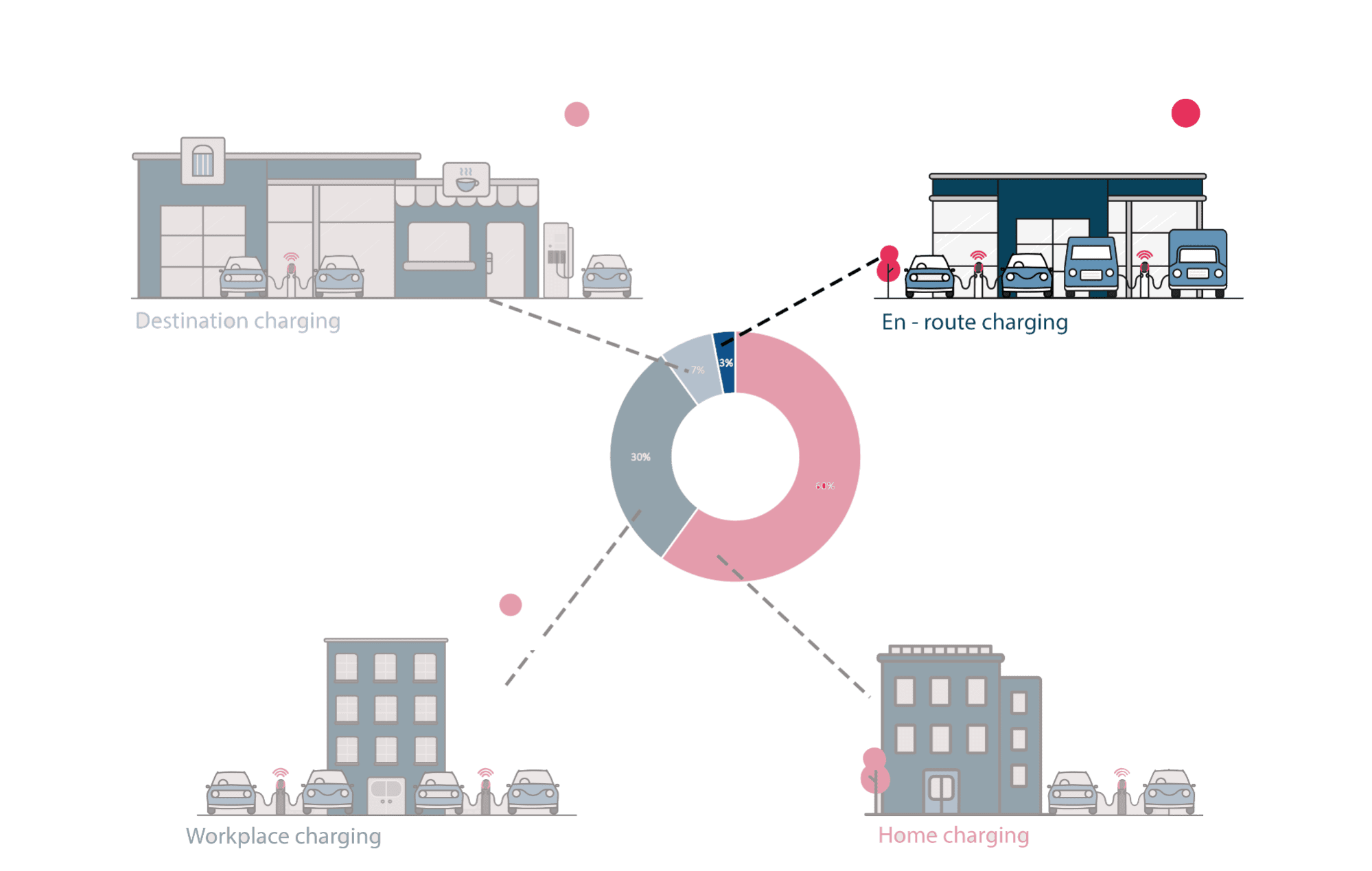

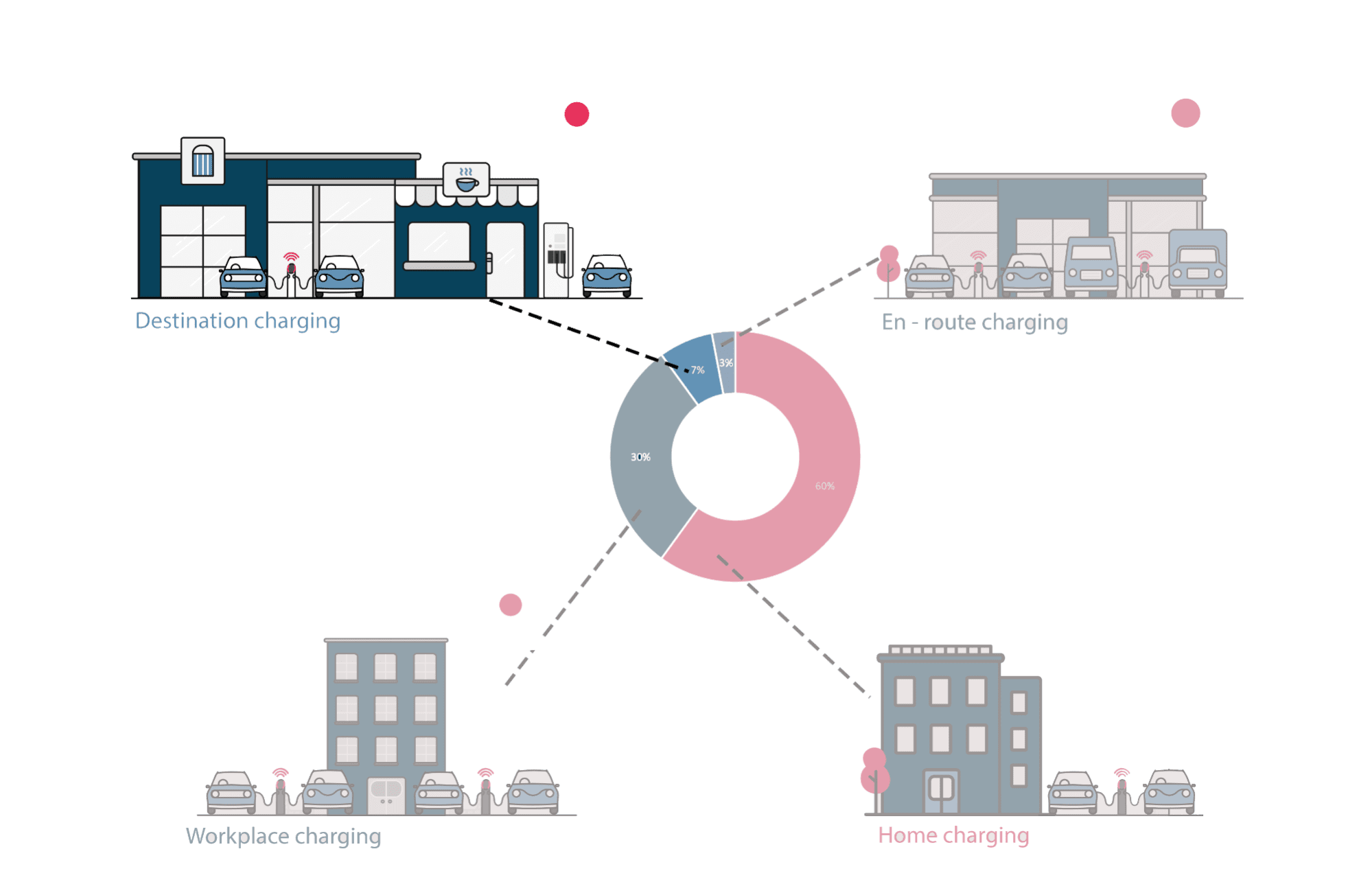

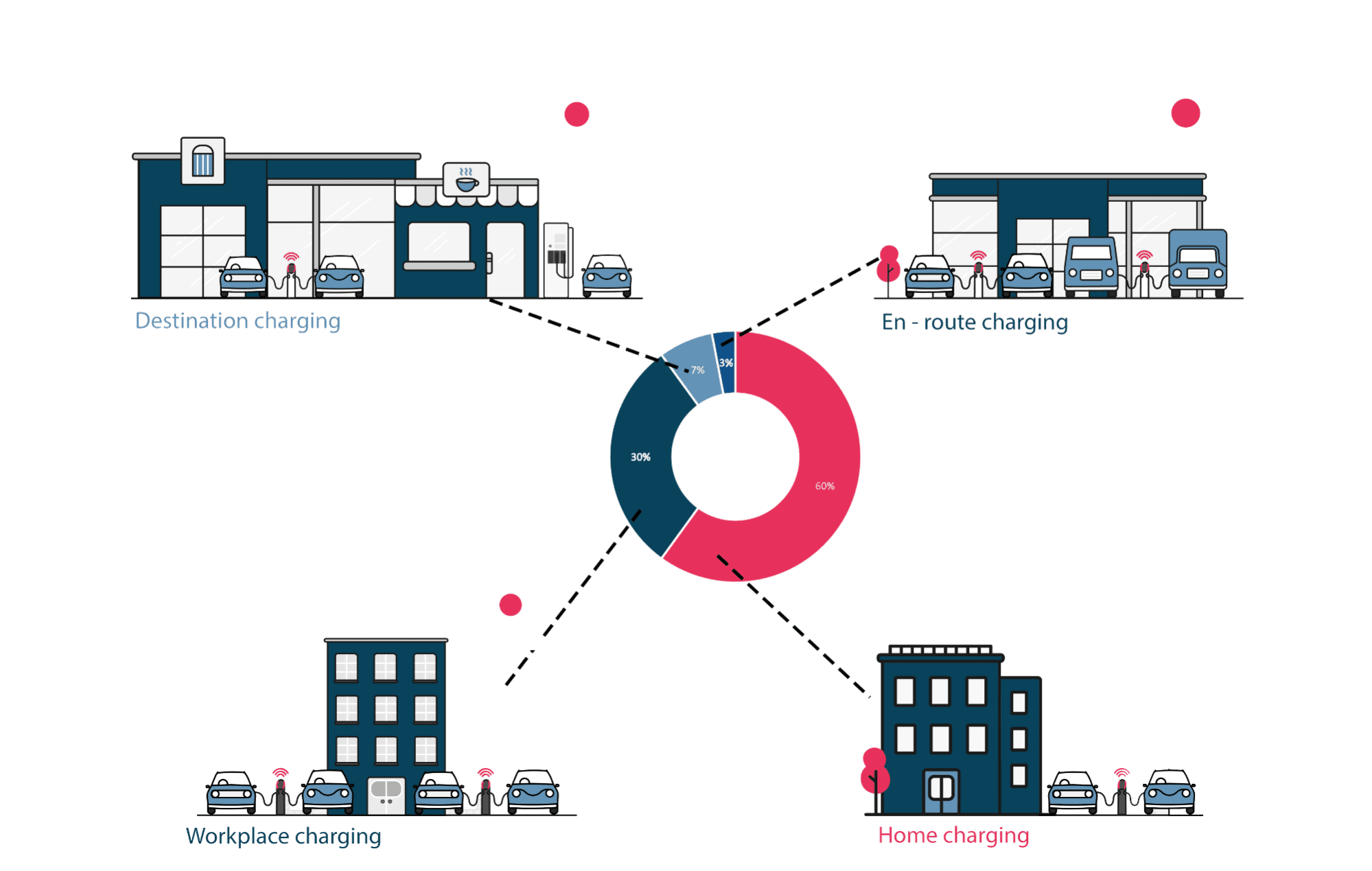

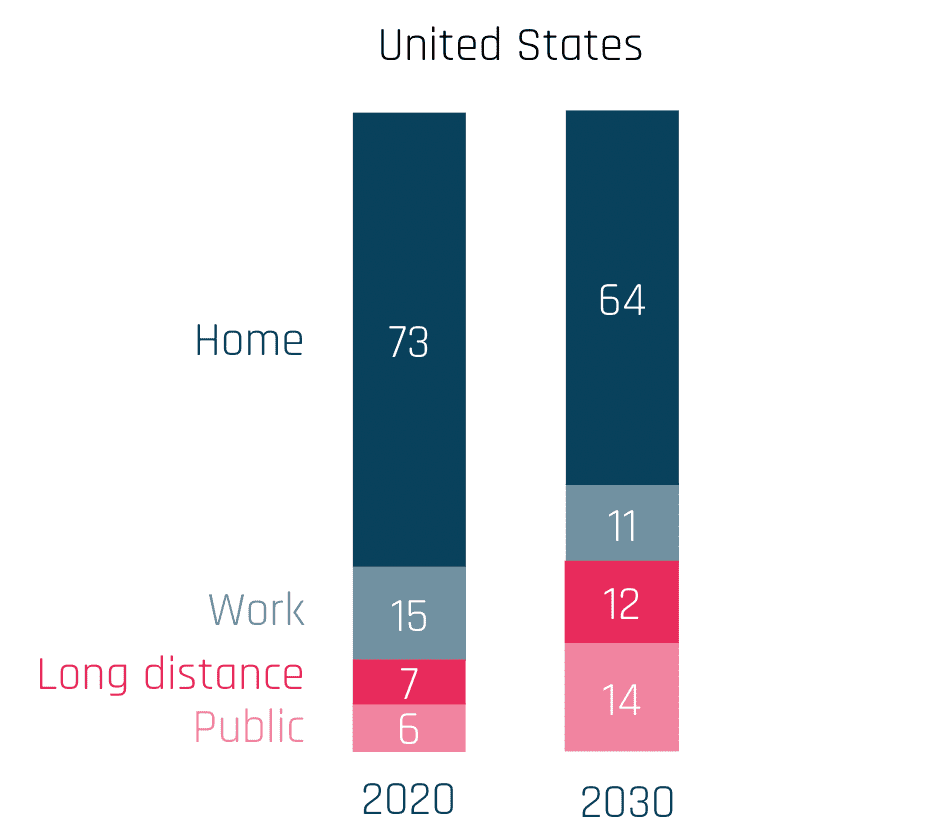

Where?

Charging as a service will probably be the primary model used by fleets. As the complexity of managing installation, maintenance, monitoring, combination with grid and energy storage facilities, and different EV users, most fleet managers will prefer to use a third party provider that will give them a complete and simple service package, such as charging access at the logistic depot, and the CaaS company will construct everything from scratch. In other words, fleet managers will only pay for the vehicle charging itself.

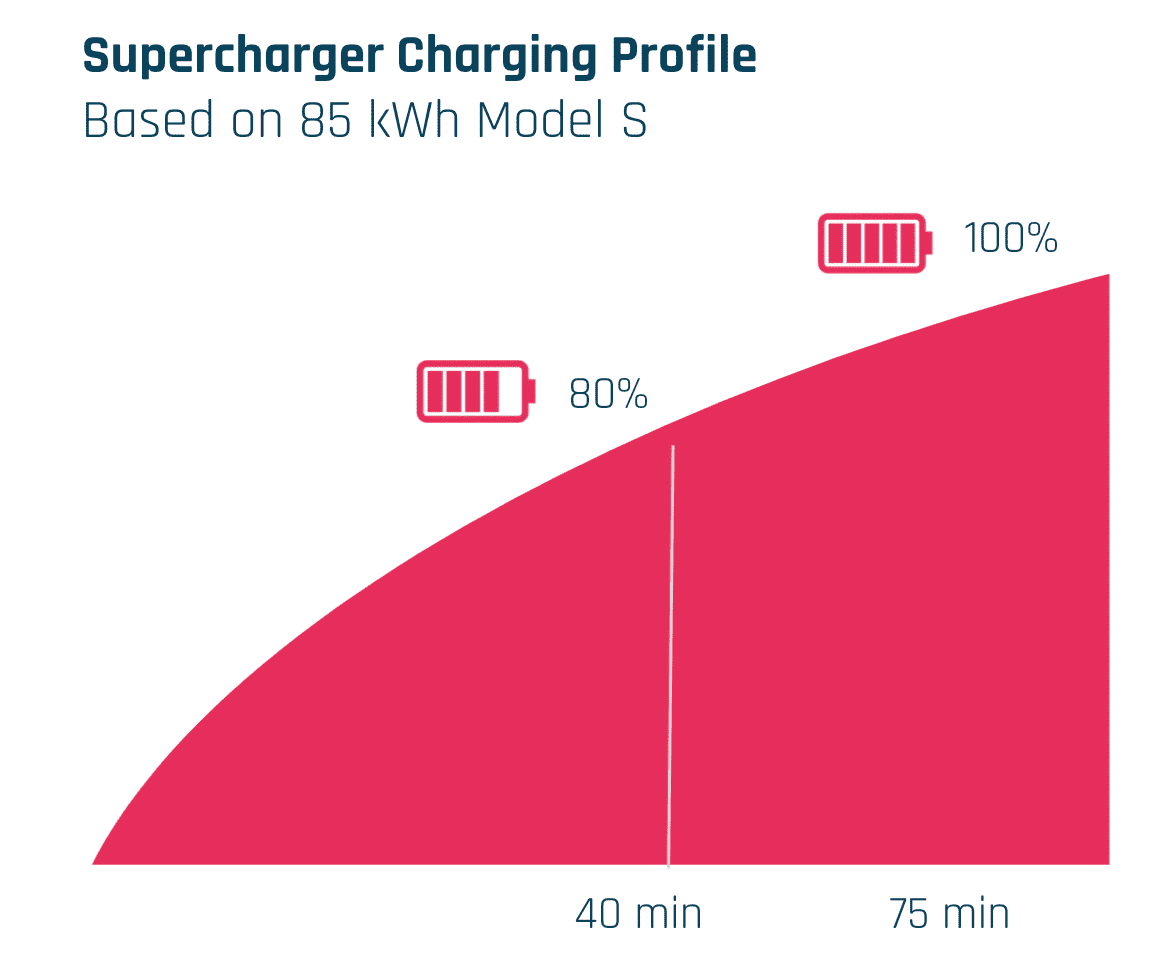

When?

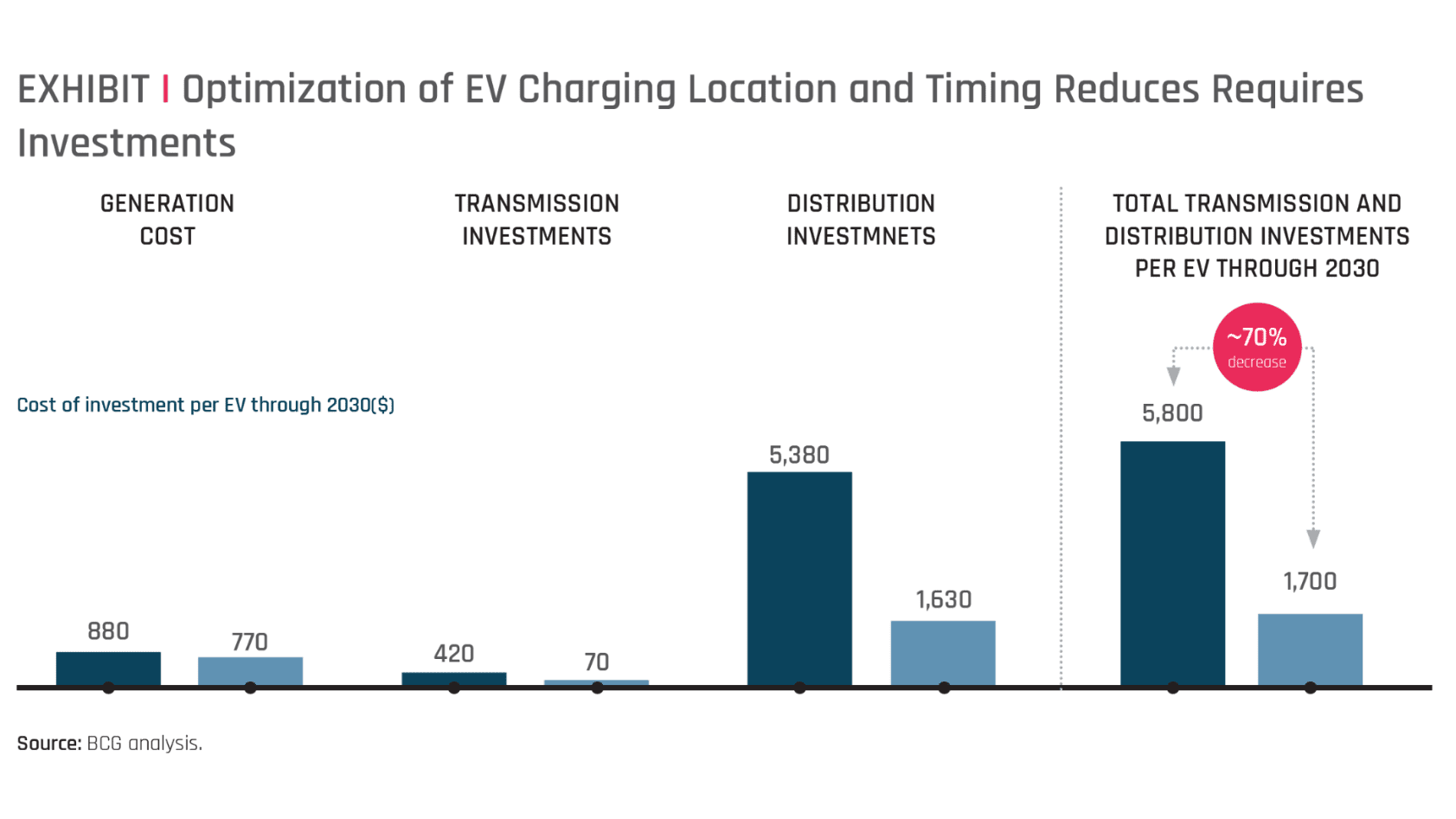

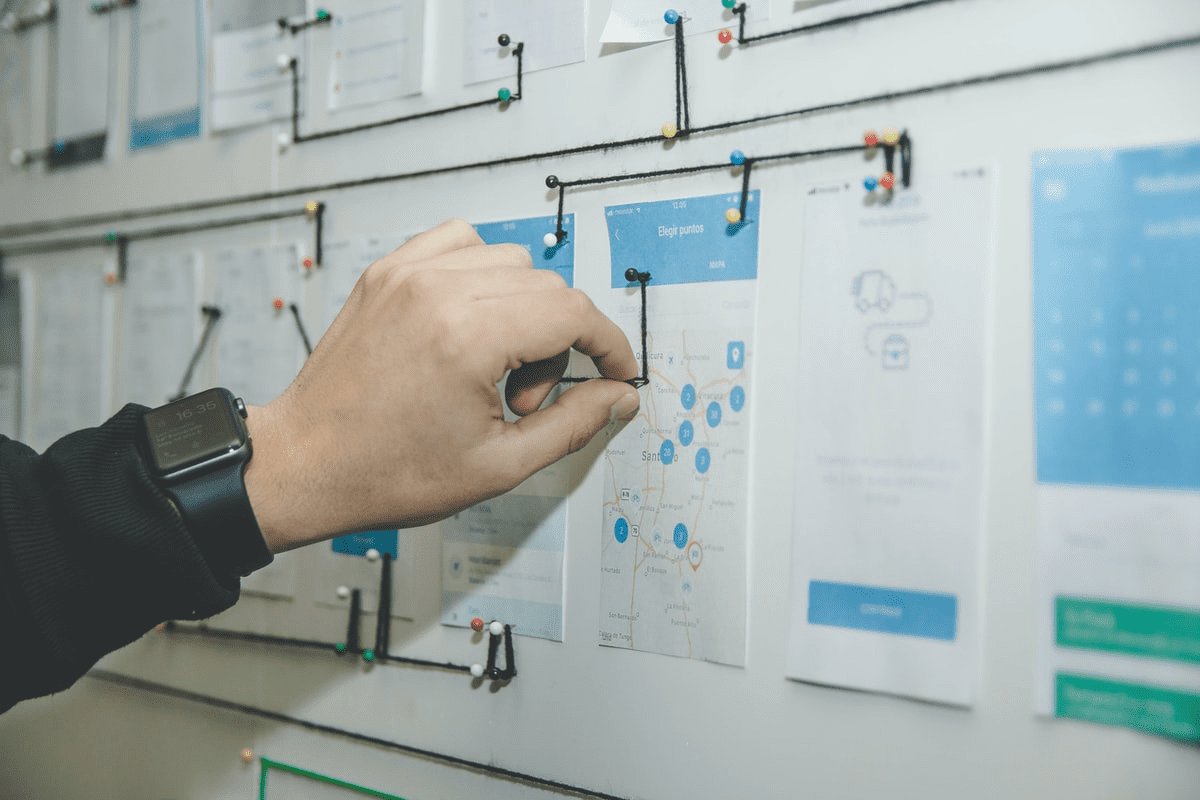

In order to schedule fleet vehicle charging, the cost of electricity, battery state, power availability and fleet tasks all need to be taken into account. For fleets with a large number of vehicles, load timing becomes a complicated task. Therefore, we expect to see increasing use of fleet management and optimization software. As EVs take up a larger and larger share of fleets, management, optimization and fleet maintenance software has a tremendous amount of room for innovation and growth.

How?

The significant load growth from an electrified commercial fleet can potentially exceed the capacity of the local existing infrastructure, requiring capital-intensive upgrades on the distribution network, and long-lead times for traditional utility upgrades. This is where microgrid solutions can help.Three primary advantages of microgrids for fleet electrification include resilience, cost savings, and carbon reduction, with varying degrees of benefit depending on the stakeholder, such as the fleet, the utility, and the general public.