Summary of Insights

The land of milk and honey continues to pioneer and innovate Agriculture-Food technologies and science. Israel’s ecosystem is tackling the most critical global challenges - far beyond milk and honey.

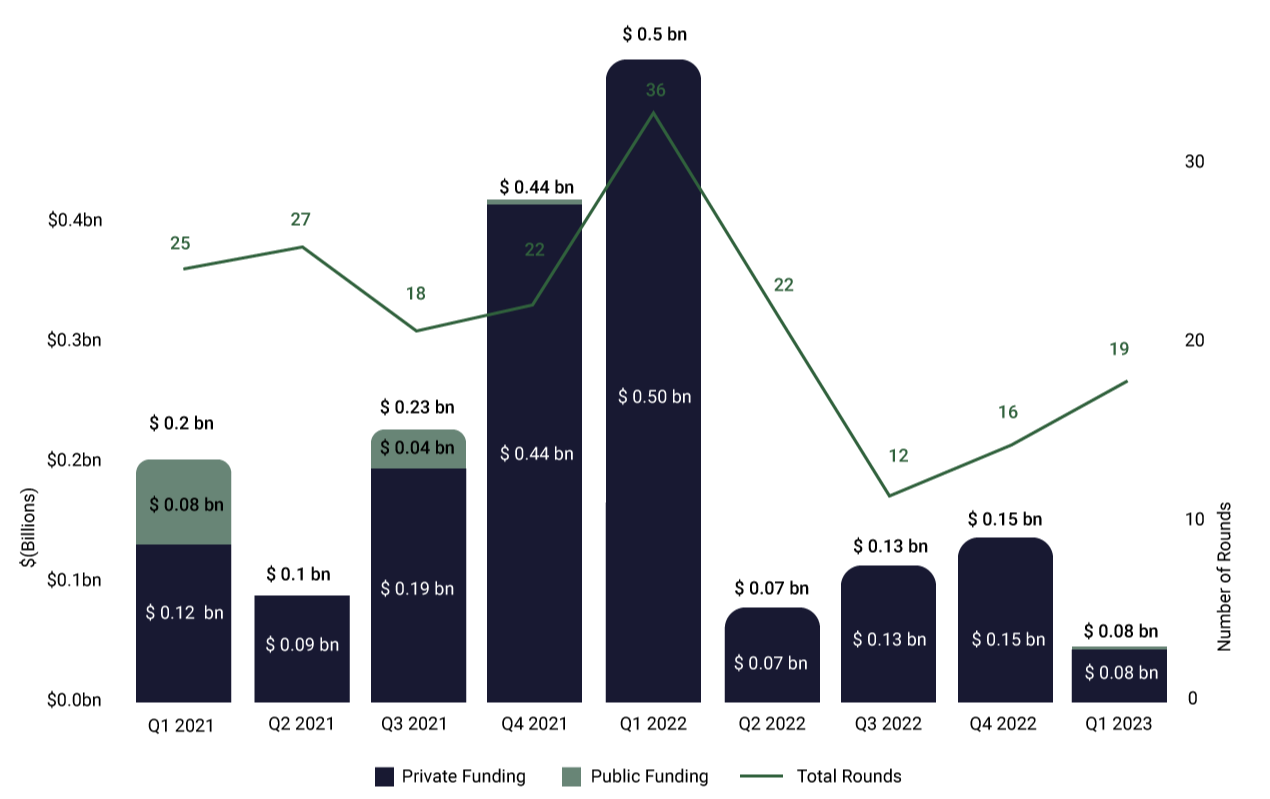

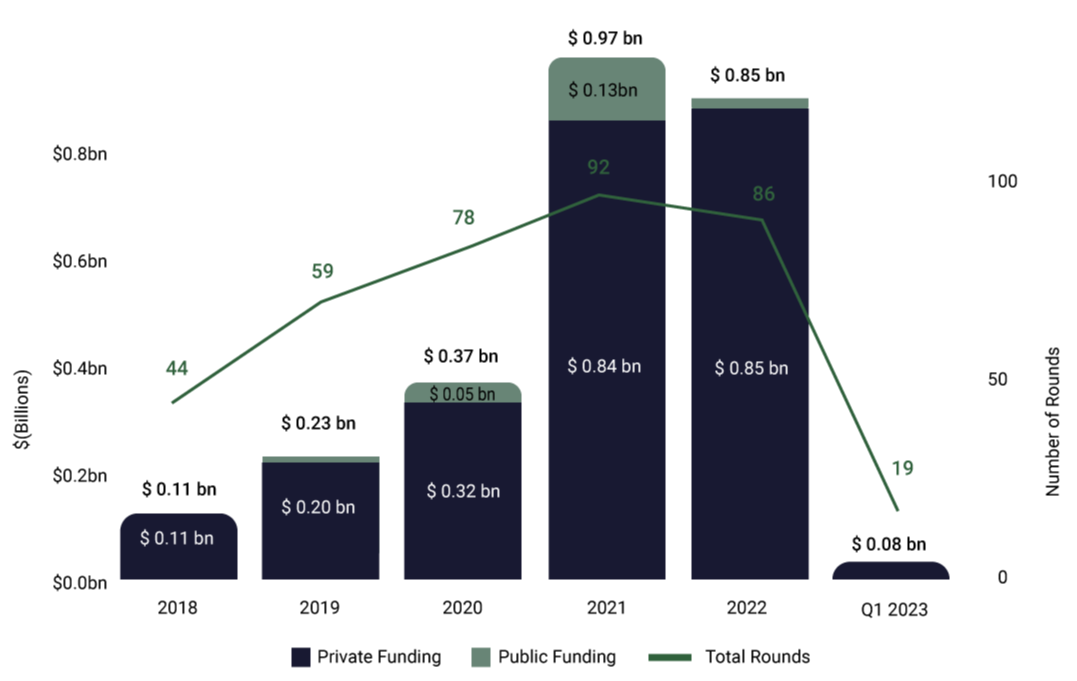

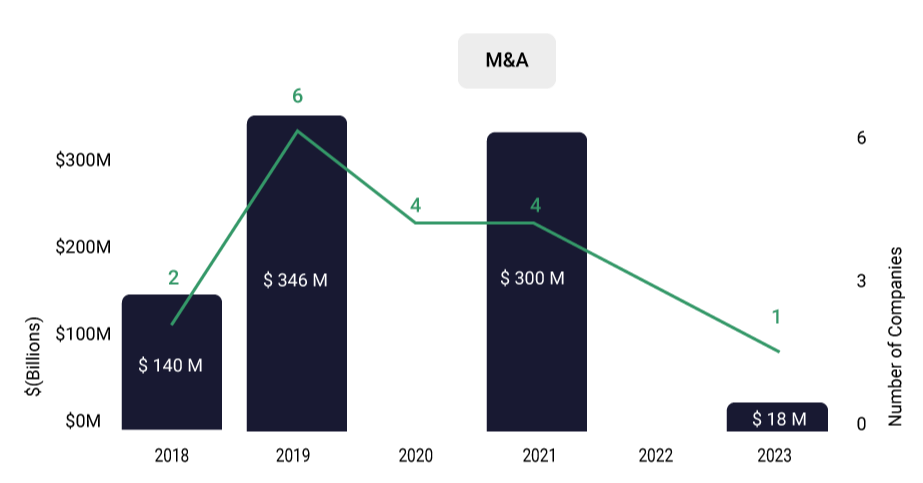

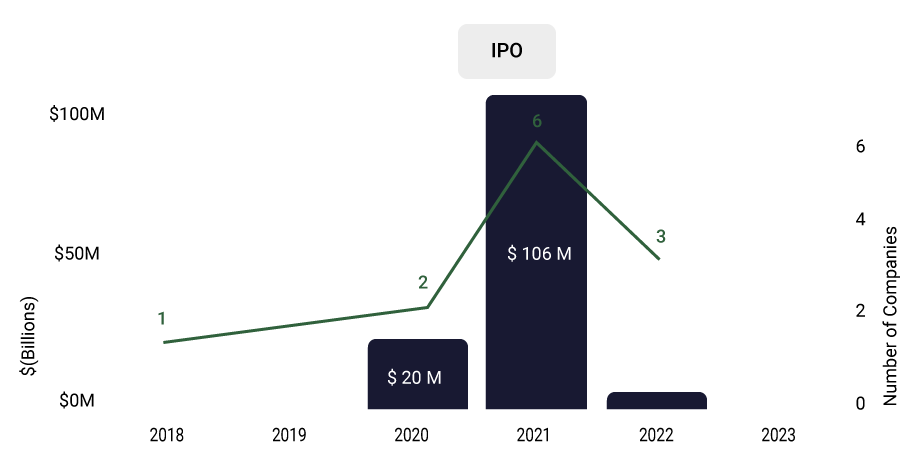

Following an outstanding 2022 followed by a global macroeconomic slowdown, Q1 2023 has clearly been a challenging quarter for the overall Agriculture-Food sector. In terms of overall investments, as well as average deal size, Q1 has reached an all-time low, however, the number of investments has only decreased slightly - investor interest remains high, and company roadmap milestones are being met.

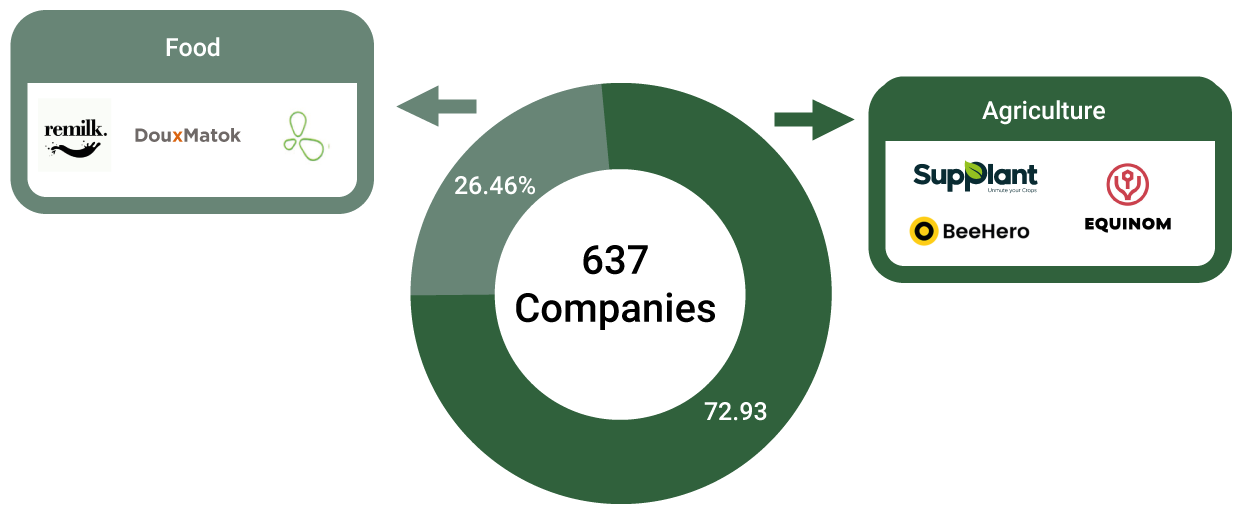

Food - Israeli food startups are continuously sprouting groundbreaking scientific advancements that enable supportive solutions for cultivated foods, novel ingredients, and packaging subsectors.

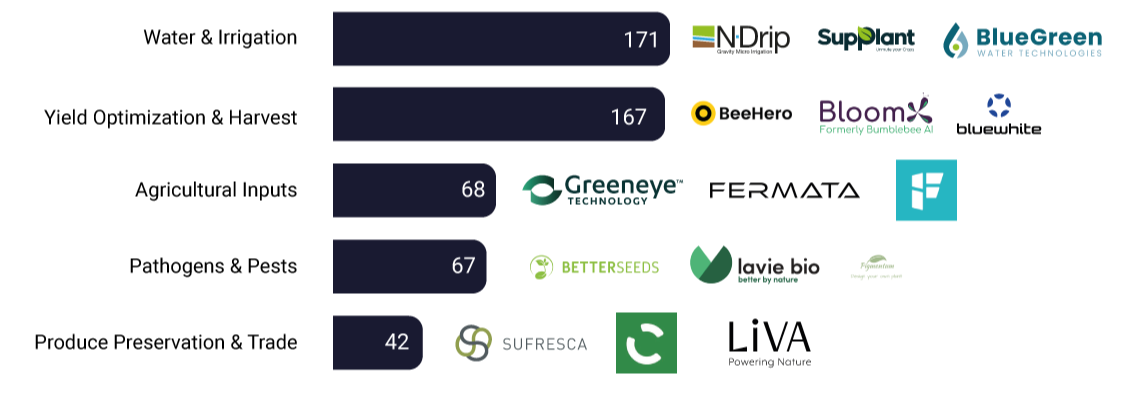

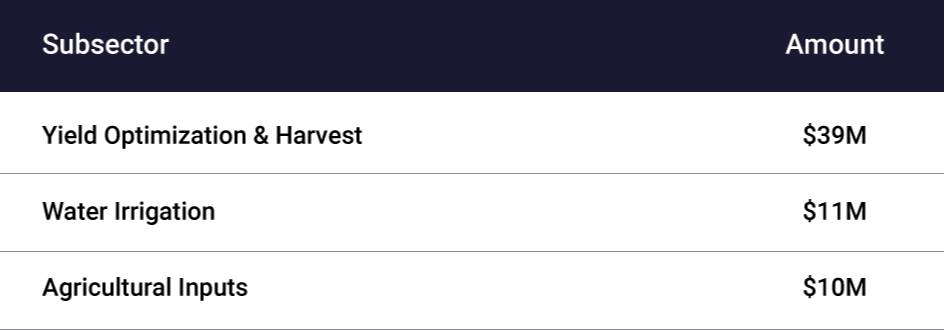

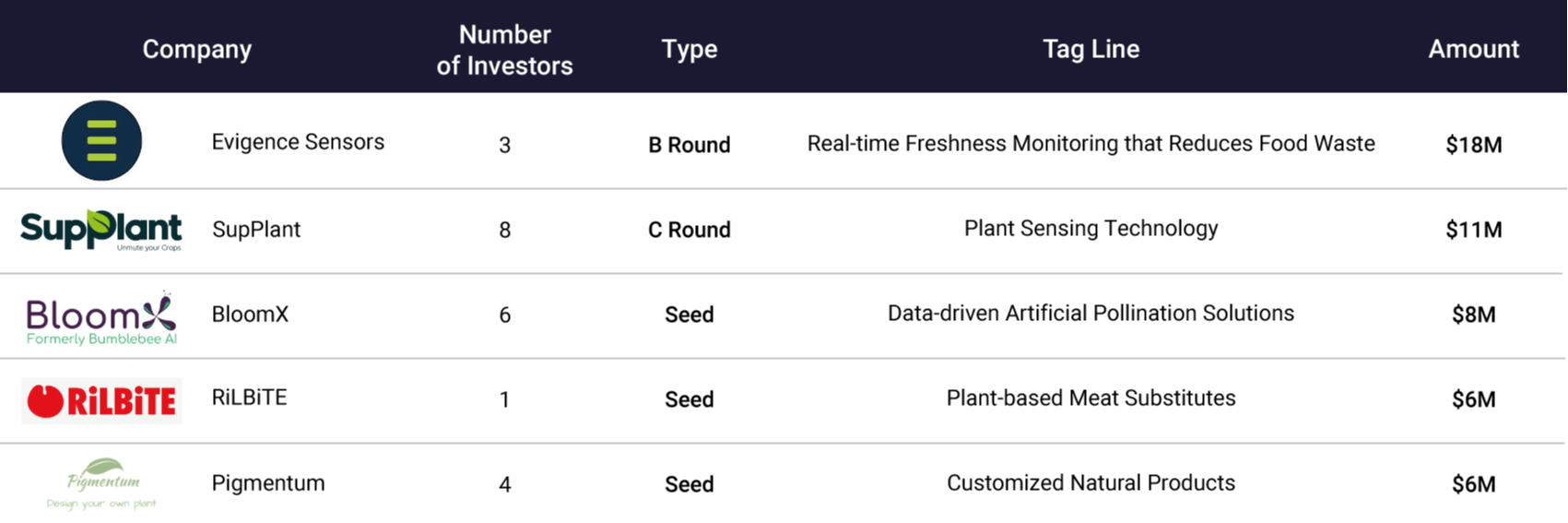

Agriculture - Autonomous and robotic solutions as well as data-based digital tools for both farmers and ecosystem stakeholders have gained the confidence of investors, proving that both the value offering and product market fit of these solutions are recognized.

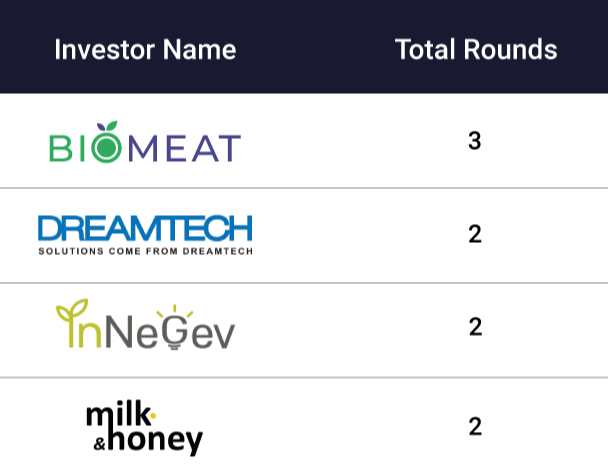

When analyzing the emerging subsectors within the Agriculture-food sector, and the supporting underlying technologies we remain confident that the ecosystem is positioned to grow.

From livestock Agriculture and crops, bee & pollination solutions, functional foods, novel ingredients, and alternative proteins, the Agriculture-Food Tech sector is reinventing traditional industries, and as such, is facing unique challenges. This is where Start-Up Nation Central steps in to support the ecosystem as a whole and the start-ups in particular.

We connect more than 100 global entities to Israeli startups every year. In addition, we map monitor, and assist companies of all kinds and at all stages to facilitate market access.

Alon TurKaspa, Agriculture-Food Tech sector lead at Start-Up Nation Central

Contact me