Make a Strong Real Estate Investment Proposal (+Examples)

Learn how to make a real estate investment deck that investors can’t resist, with practical real estate investment proposal examples usable as templates.

Learn how to make a real estate investment deck that investors can’t resist, with practical real estate investment proposal examples usable as templates.

Short answer

Research your investors

Craft a personalised cover slide

Write an executive summary

Conduct market analysis

Present detailed property information

Outline expected ROI

Conduct risk assessment

Present financial and legal details

Define an exit strategy

Include supporting documents

Provide next steps for the investor

Keep reading for a full breakdown ⤵

How to structure your market analysis slide

Start off by taking a close look at the market. Bring in data from industry reports, demographic details, and economic forecasts to support your points. This sets the stage by showing what the market looks like right now and where it's heading.

Next, size up the competition. Look at how similar properties are performing and how yours compares. This step highlights the potential of your project.

Then, talk about your target tenants. Explain how choosing the right mix of tenants is designed to attract a diverse group of people who will keep coming back.

Finish with why you chose this location. Use maps and traffic studies to show why this particular spot is ideal.

What to cover in the property information section

Start with the basics—location, size, appearance, and those unique features that make it different from anything else out there.

Then, talk about the previous owners, any improvements it’s seen, and any memorable moments that add a bit of character.

Next, give a snapshot of its current condition, price, and what it could be worth in the future. Back that up with why this property makes sense for your goals, based on what the market’s telling you.

If you’re thinking about making upgrades or renovations, be clear about what you’re planning. It’s key to show how these improvements will boost the property’s value, not just throw money at it. Make it obvious that these changes are smart moves that line up with what’s happening in the market.

What to mention in the risk assessment section

Think about the risks that could impact your investment. Maybe the market takes a downturn, dropping property values, or you get hit with higher-than-expected tenant turnover, messing with your cash flow.

New regulations might also come into play, changing how properties need to be managed—remember how the infamous LA mansion tax threw the whole market out of whack?

Next, explain how you’re going to handle these challenges. For example, diversifying your portfolio can help you ride out market swings. Building good relationships with tenants can keep turnover low. And staying on top of the latest regulations will make sure you stay compliant and avoid any legal headaches.

How to present the financial and legal details

Financial options: Start by listing the different ways investors can fund the project—this could be through personal savings, bank loans (e.g., use a VA loan calculator), or partnerships. Explain the pros and cons of each, like how loans have interest rates but partnerships might involve sharing profits. Mention any financial perks or tax benefits that could be available too.

Legal details: Give a clear overview of the legal responsibilities linked to the investment. Touch on things like zoning laws, property regulations, and any compliance needs.

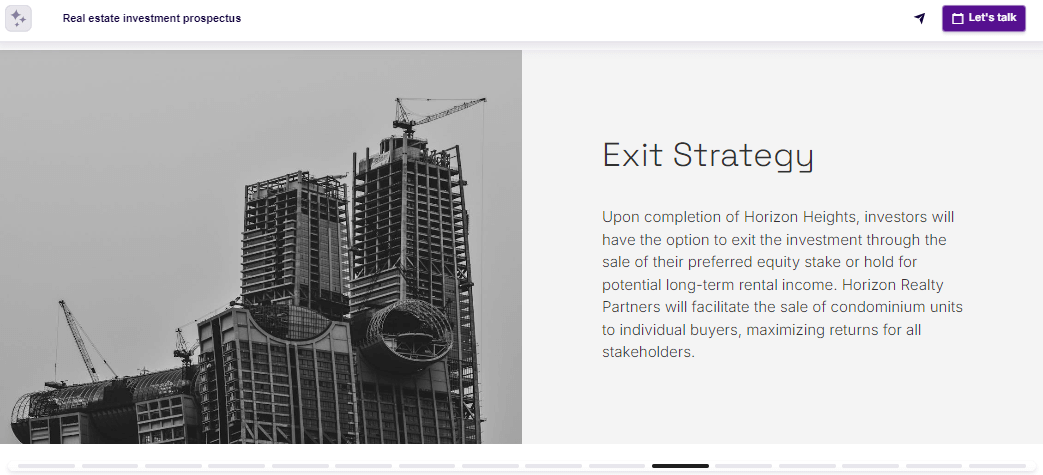

2 most common exit strategy approaches

Resale: One common approach is to sell the property. This strategy works well when you catch the market at the right time. Success depends on a good understanding of market trends, the property’s condition, and the purchase price.

Refinancing: Another approach is refinancing, which lets investors cash out some of the property’s value while keeping ownership. This can be a smart move if you’re not ready to sell but need funds for other investments or improvements. It’s a strategy that fits well with a long-term hold, helping to stabilize cash flow and potentially increase the property’s value over time.

Make sure to clearly outline when and how you plan to sell or refinance, what you expect to gain from it, and what your backup plans are if things don’t go as planned.

This demonstrates that you’re thinking ahead and are ready for different scenarios, which can be reassuring for investors.

Examples of documents to include in your proposal

Financial statements: Show both the current and projected financials for the property. Include income statements, balance sheets, and cash flow forecasts to give a clear view of the property’s financial situation.

Market analysis: Take a close look at the local real estate market. Highlight the key trends, use comps to compare similar properties, and share your predictions to show why this property is a smart investment.

Legal documents: Include important legal papers like the title deeds, any zoning permissions, and compliance certificates. These show that the property is legally sound and set for development or sale.

Property appraisal: A recent appraisal report is essential as it offers an independent valuation of the property, supporting your pricing and investment strategy.

Stop losing opportunities to ineffective presentations.

Your new amazing deck is one click away!