Summary of Insights

A Guest Commentary by YL Ventures based on data collected by Start-Up Nation Finder.

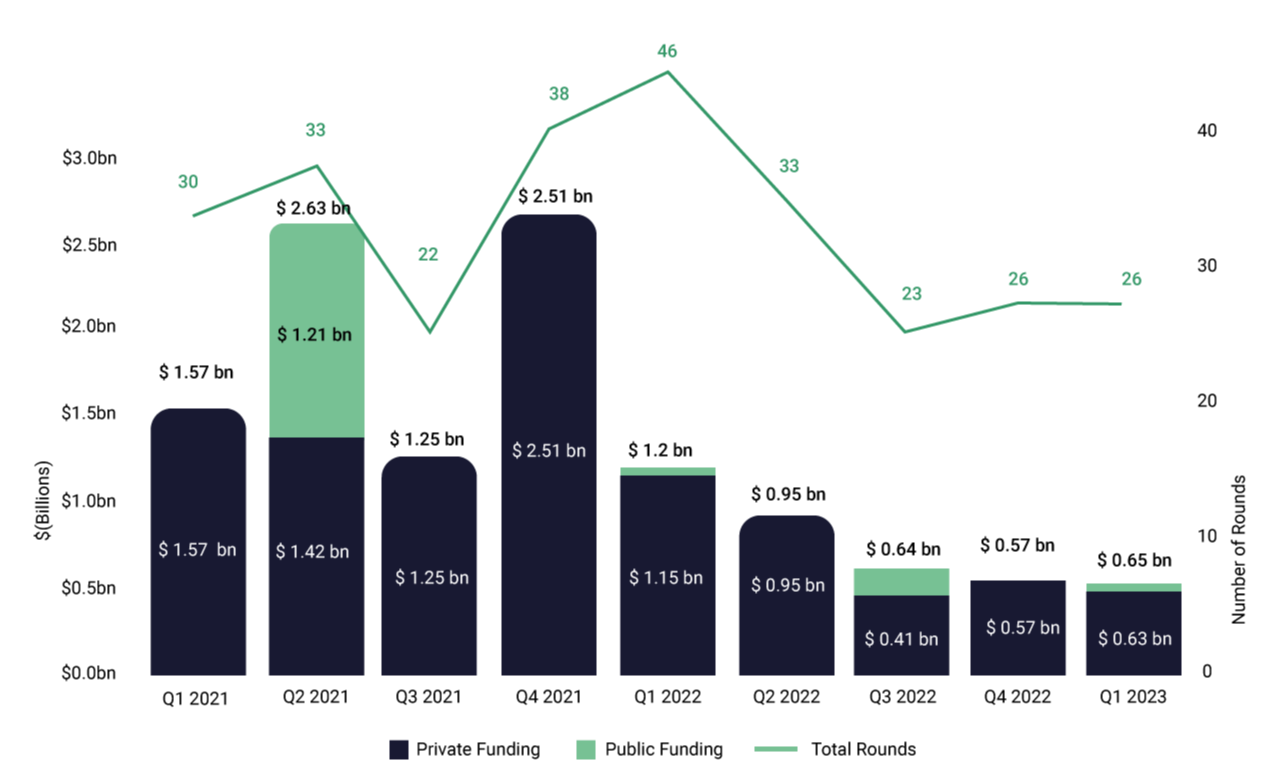

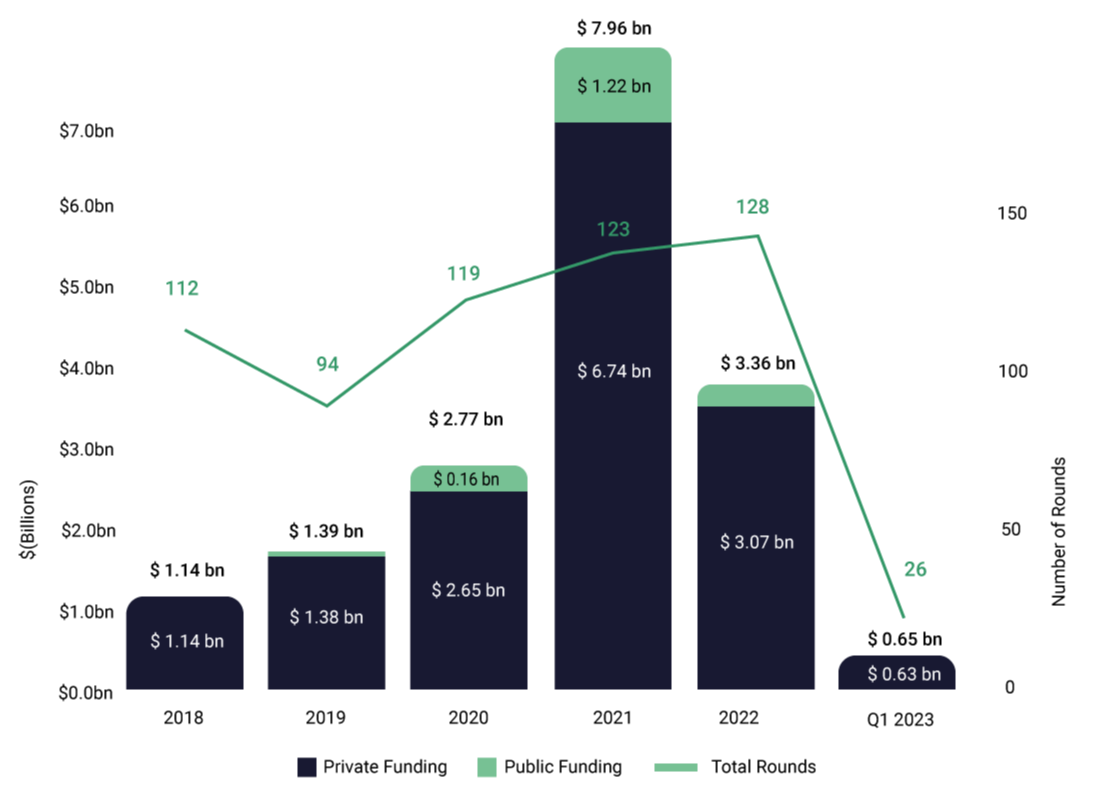

Assessing the performance of the Q1 2023 cybersecurity investment landscape requires a sobering perspective following the extraordinary peak of 2021 and the stark decline of 2022. While the market’s vacillations have indeed dramatically impacted investor risk appetites, investor interest in cybersecurity innovation this quarter remained high.

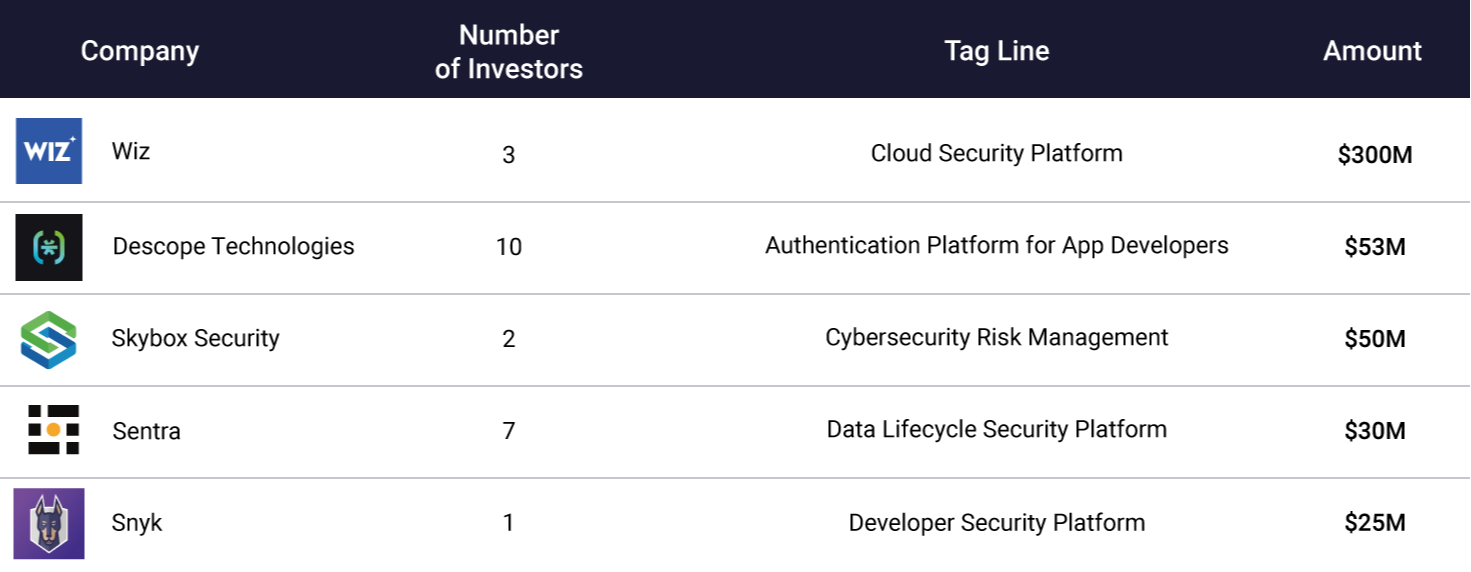

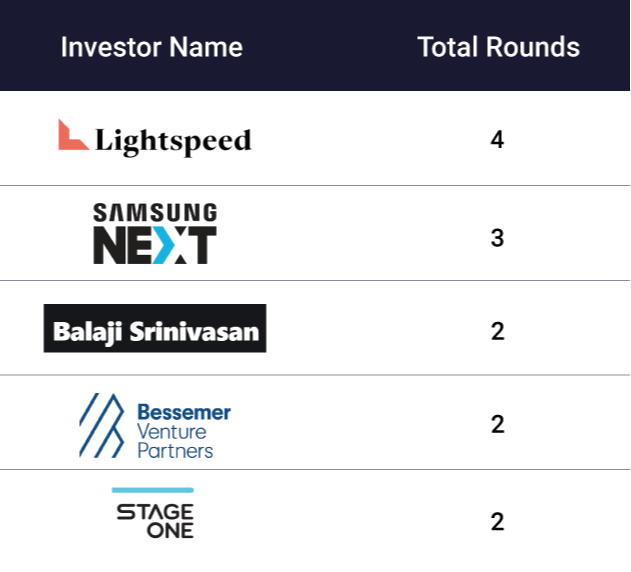

The growing sophistication of malicious actors has underlined the importance of prioritizing security as a leading budget item, and this quarter’s data shows that investors are still willing to bet handsomely on groundbreaking technology built by promising startups, and want to see a consolidation of capabilities in one solution that can resolve multiple problems.

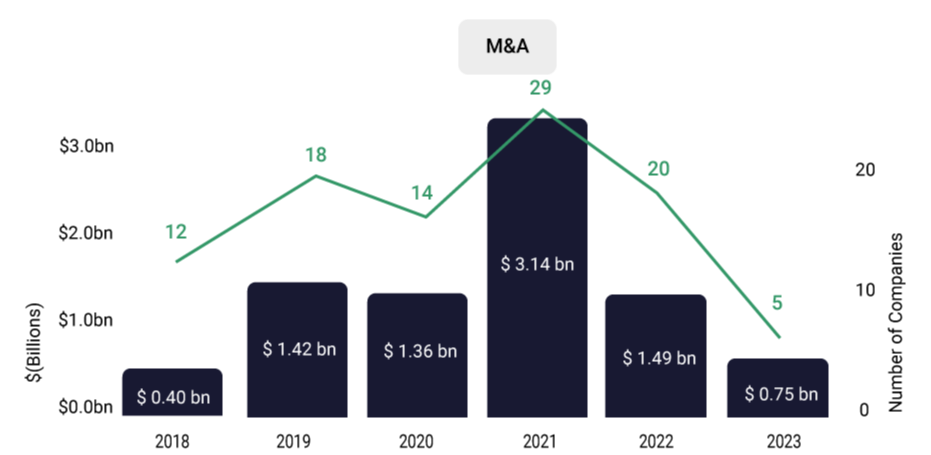

Consolidation has also become an operative word on the M&A front. Post-2022, acquisitions have become a potential safety net for startups severely affected by the economic downturn. Some contend with decreased valuations that make it difficult to raise follow-on rounds, others have experienced aggressive growth over the past two years and are now finding their runway significantly diminished, and other startups previously raised capital at high valuations without backing it up with ARR (Annually Recurring Revenue) and real customer traction. Large vendors - determined to expand their offerings before the competition does - happily acquire them.

"If Q1 is any indication, cybersecurity will remain a top-quartile investment sector with hesitant but enthusiastic investors, eager to find the next great cybersecurity solution.”

Ofer Schreiber, Senior Partner, YL Ventures