How to Create a Startup One-Pager That Wows Investors

Learn how to make a startup one-pager for investors that makes you stand out. Know what info to include and what answers to give to get funded.

Learn how to make a startup one-pager for investors that makes you stand out. Know what info to include and what answers to give to get funded.

Make it short (though not necessarily a 1 page pitch)

Sell your company and yourself

Demonstrate deep knowledge of your business and market

Outline your unique value proposition and competitive advantage

Demonstrate your solution’s impact on your target audience

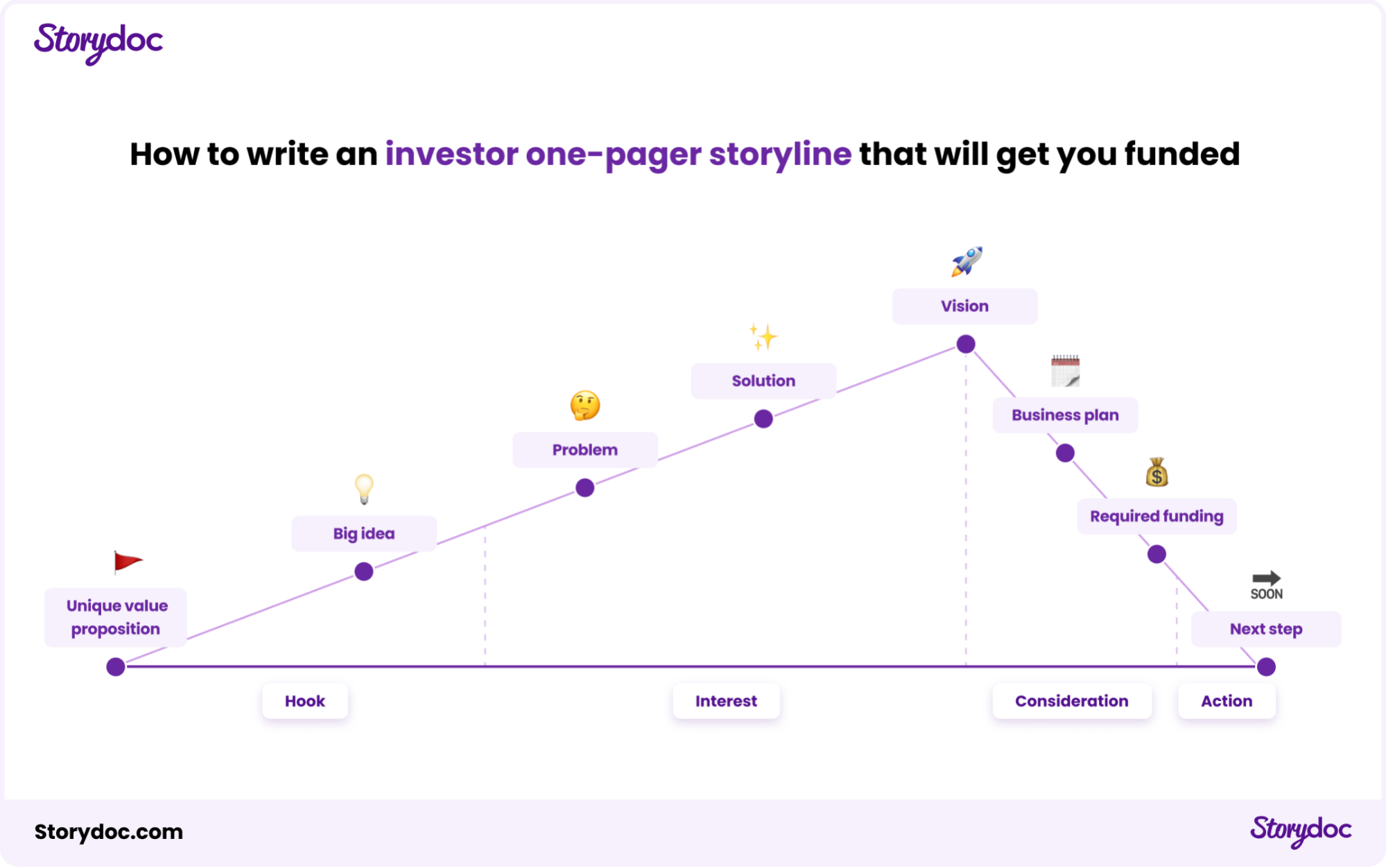

Craft a compelling narrative

Create flow

Design visuals that bring your startup one-pager to life

Include clear next steps

Link out to supporting documents

TIP: A well-crafted one-pager should also include visual elements such as logos and infographics to break up text and make the information more easily digestible.

TIP: Your UVP should be short and sweet yet easy to understand. Keep it between 14-30 words. This way you avoid making it so short that it's unintelligible or so long that you lose people's attention.

TIP: Use real numbers, graphs, and charts to back your claims and gain credibility.

TIP: Cutting down on unnecessary words can make each piece succinct yet memorable.

TIP: Include contact information to all forms of acceptable communication (such as email, phone, LinkedIn, Whatsapp, Messenger, and Slack). Make sure your contact information is correct and up-to-date.

Try Storydoc for free for 14 days (keep anything you make for ever!)