Raising money in 2026 is brutal.

Investors are busier, pickier, and more distracted than ever. They’re opening more decks, scanning faster, and bouncing at record rates. AI-generated pitches flood inboxes, making it harder than ever to stand out - or be taken seriously.

The funding pool is growing - $91 billion was raised in Q2 of 2025 alone - but most of that capital is going to the top.

In fact, a third of all funding in Q2 went to the largest companies. That leaves early-stage founders competing for attention in a market where everyone wants a piece, but only a few get it.

Meanwhile, the volume keeps climbing. On average, 137,000 new startups are launched every day, and 90% of them fail. The ones that survive have a great story, and they know how to tell it.

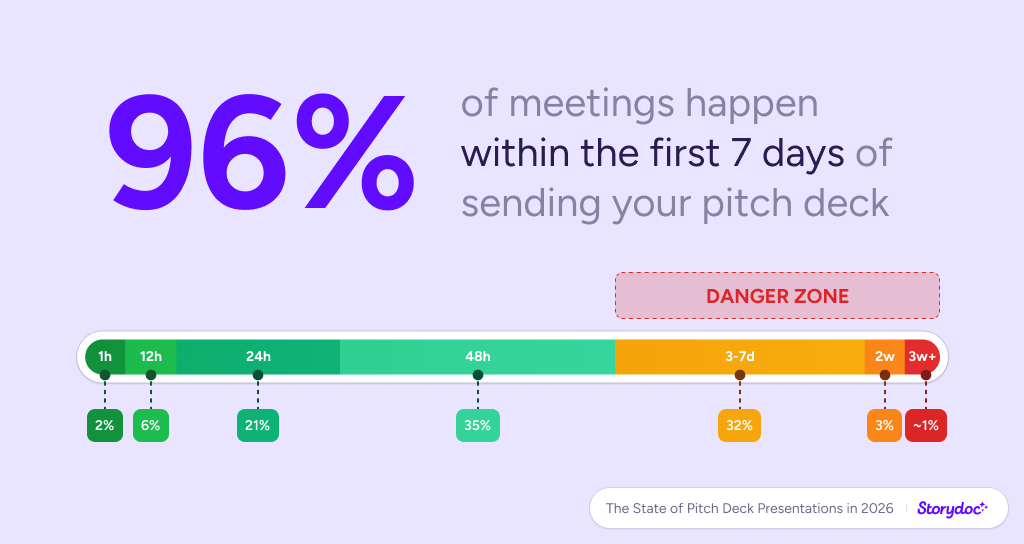

We analyzed over 1.3 million real presentation sessions to figure out how investors actually engage with decks - what they read, what they skip, and what makes them take action.

This isn’t recycled advice or founder folklore. It’s the reality of pitching in 2026 - and what you need to do to make it through.